.

This One Needs a Second Look…

Don’t forget to cast your vote 👇

The Headline

This was the first inflation print since the shutdown — and the first real chance to see whether price pressures are actually easing or just stuck.

And on the surface, it looked like a clear win for the “cuts are coming” crowd:

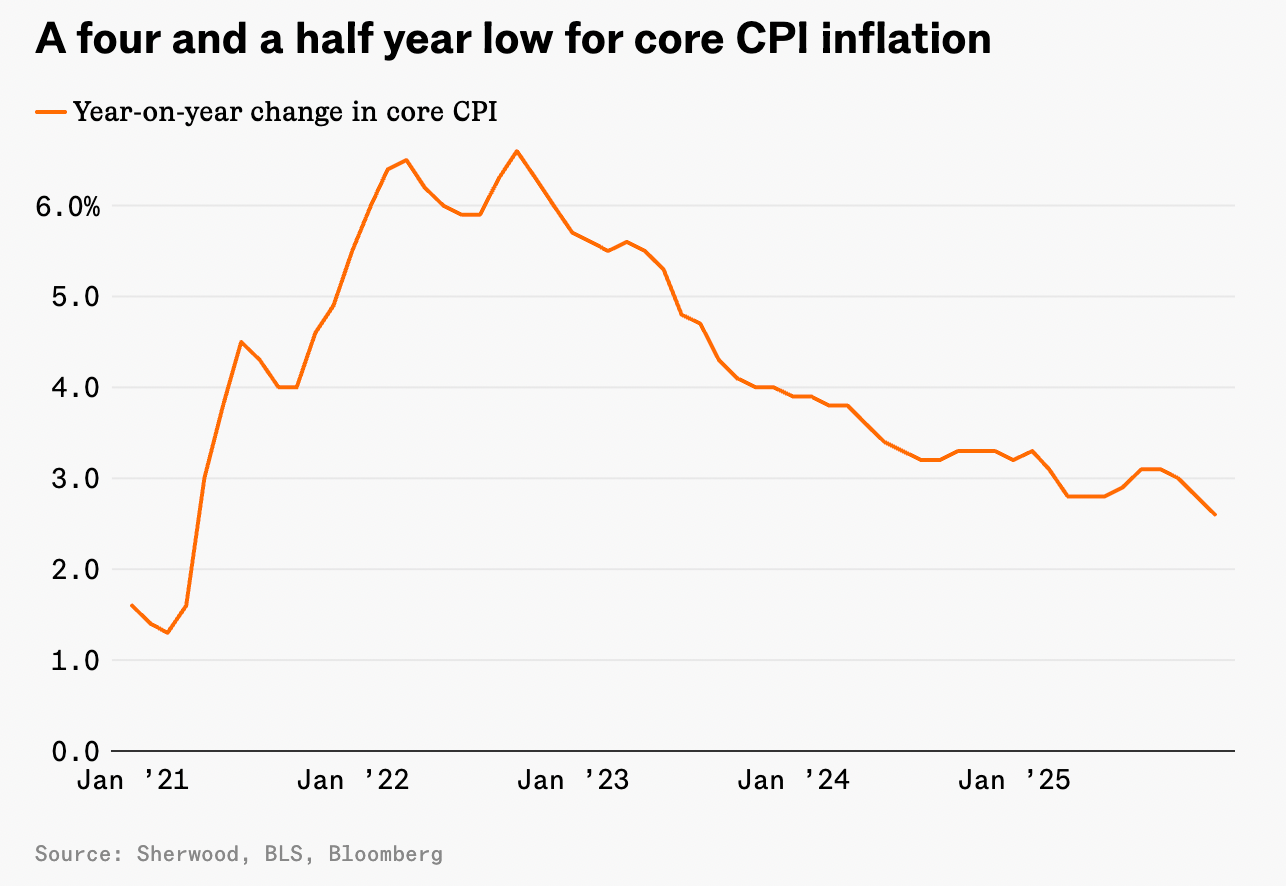

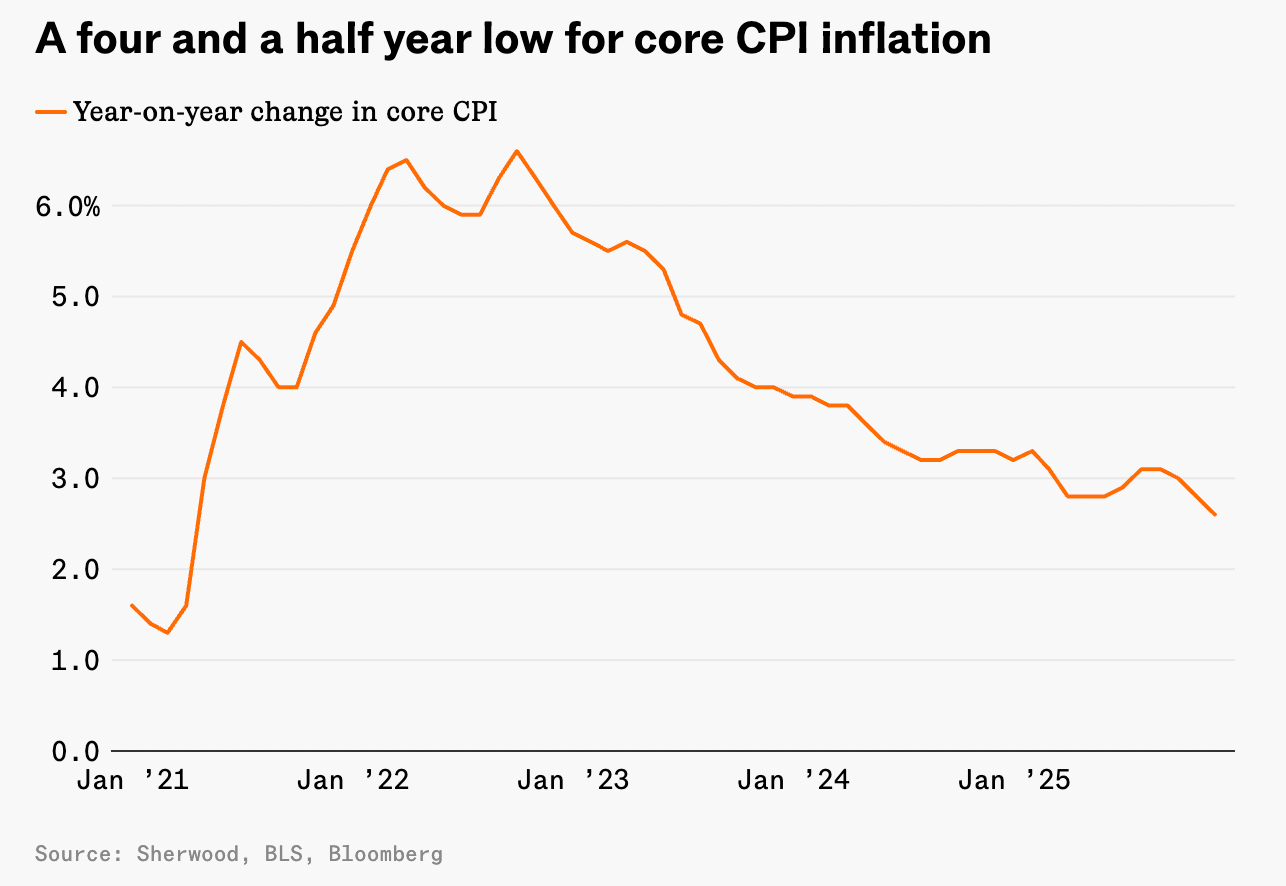

CPI: +2.7% YoY (vs. 3.1% expected)

Core CPI: +2.6% YoY (vs. 3.0% expected)

Lowest core inflation since March 2021

Markets reacted quickly. Stocks moved higher. Rate-cut odds nudged up.

The Fed took a different view.

This report came with gaps, and missing data makes it harder to draw firm conclusions. For policymakers, that means less reacting — and more waiting.

THE BREAKDOWN:

1) Why This Print Is Tricky

This CPI report came with missing data.

Because of the government shutdown, the Bureau of Labor Statistics:

Did not collect price data for over a month

Could not publish month-over-month figures

Made statistical assumptions to fill gaps, especially in rent and owners’ equivalent rent (OER)

In fact, analysts noted the BLS effectively assumed October rent inflation was zero, which helped drag headline and core numbers lower.

That doesn’t invalidate the report — but it does limit confidence.

As Fed Chair Powell warned last week, this print deserves a “skeptical eye.”

2) Where Inflation Lost Some Steam

Even with the data noise, some real trends stood out:

Rents declined → Shelter is the single biggest weight in CPI, and it’s also the stickiest. A pullback here does more to cool inflation expectations than almost anything else — which is why Fed officials keep coming back to it.

Services inflation (ex-energy) eased to 3%, down from 3.5% → This is the category hawks watch most closely. It’s still elevated, but the direction matters. A move lower suggests pricing power in services is finally starting to soften.

Tariff pass-through remained muted → Despite higher duties, companies haven’t been able to push costs through to consumers in a meaningful way. That undercuts the argument that trade policy will re-ignite inflation on its own.

The labor market continues to loosen → Unemployment is now at a four-year high, and wage pressure is easing. A softer jobs backdrop reduces the risk of demand-driven inflation making a comeback.

None of this is a victory lap.

But it’s enough to keep the disinflation narrative alive.

3) Wait-and-Verify Mode

The Fed isn’t declaring victory — but it isn’t uncomfortable with what it saw either.

→ Powell: He signaled caution, not resistance. The Fed wants to see whether this cooling shows up again once data collection fully normalizes.

→ Waller: Inflation likely cools further in the first half of the year.

That matters because it keeps the path toward gradual cuts open. Waller’s message wasn’t urgency — it was patience with optionality.

→ Miran: Falling rents make easing defensible, even with tariffs.

Shelter costs are doing the heavy lifting in CPI. If rents continue to roll over, inflation looks lower beneath the surface, blunting concerns about tariff-driven pressure.

❗Markets picked up on that balance.

4) What the Market Heard:

Inflation is cooling faster than expected

Core CPI at 2.6% = lowest since March 2021

Rate cuts are back on the table

Stocks higher, cut odds up, risk back in play

Translation: “Disinflation is here. The Fed has room to move.”

→ January cut odds moved from roughly 25% to above 30%.

→ Later-year cut expectations remain elevated, but not locked in.

This wasn’t a rush into dovish bets. It was a lean.

❗ The missing piece is still the Fed’s preferred gauge.

→ Core PCE hasn’t updated yet — and that’s what policymakers ultimately anchor to.

Several economists think this CPI print likely maps to core PCE around ~2.7%, down from 2.9%, but that still needs confirmation.

Net result: inflation isn’t solved — but it’s cooperating.

That keeps the Fed in wait-and-verify mode, with the option to cut still very much alive if the next set of data backs this up.

THE TAKEAWAY:

Good direction. Low conviction.

Inflation may be cooling.

Or this could be a statistical blip.

The Fed won’t cut because of this report —

but it’s now easier to justify cutting if the next one confirms it.

Not a green light.

More like a yellow flashing caution — pointing toward easier policy, if the data holds.

LESSON OF THE DAY:

Lesson of the Day: How To Read CPI

What it measures: The Fed’s primary gauge for inflation — tracking price changes across goods and services.

The target zone: ~2–3% YoY. Above it, policy tightens. Below it, pressure eases.

How Markets Interpret CPI:

High CPI (> Forecast): Inflation is hot.

→ Fed stays restrictive

→ Rates remain elevated

→ Liquidity tightens

Low CPI (< Forecast): Inflation cools.

→ Pivot expectations rise

→ Rate cuts move forward

→ Liquidity improves, it is a s

imple reaction chain:

❗CPI ↓ → Cut odds ↑ → Stocks ↑ → Dollar ↓

Market Impact Cheat Sheet

USD: High CPI → bullish (higher rate path)

Gold & Crypto: High CPI → bearish (risk-off pressure)

But only if the data holds up.

💬 We Want To Hear Your Story:

Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

Was this email forwarded to you? Don’t miss out on future stories — subscribe to the TradingLessons and get our daily market breakdown delivered straight to your inbox.

Banish bad ads for good

Your site, your ad choices.

Don’t let intrusive ads ruin the experience for the audience you’ve worked hard to build.

With Google AdSense, you can ensure only the ads you want appear on your site, making it the strongest and most compelling option.

Don’t just take our word for it. DIY Eule, one of Germany’s largest sewing content creators says, “With Google AdSense, I can customize the placement, amount, and layout of ads on my site.”

Google AdSense gives you full control to customize exactly where you want ads—and where you don’t. Use the powerful controls to designate ad-free zones, ensuring a positive user experience.

❗ P.S. – If you no longer want to receive occasional emails from us and you want to unsubscribe, scroll to the bottom of this email and click the “Unsubscribe” link located right under the disclaimer 👇