.

Did Gold Miss the Memo About Being Replaced?

Don’t forget to cast your vote 👇

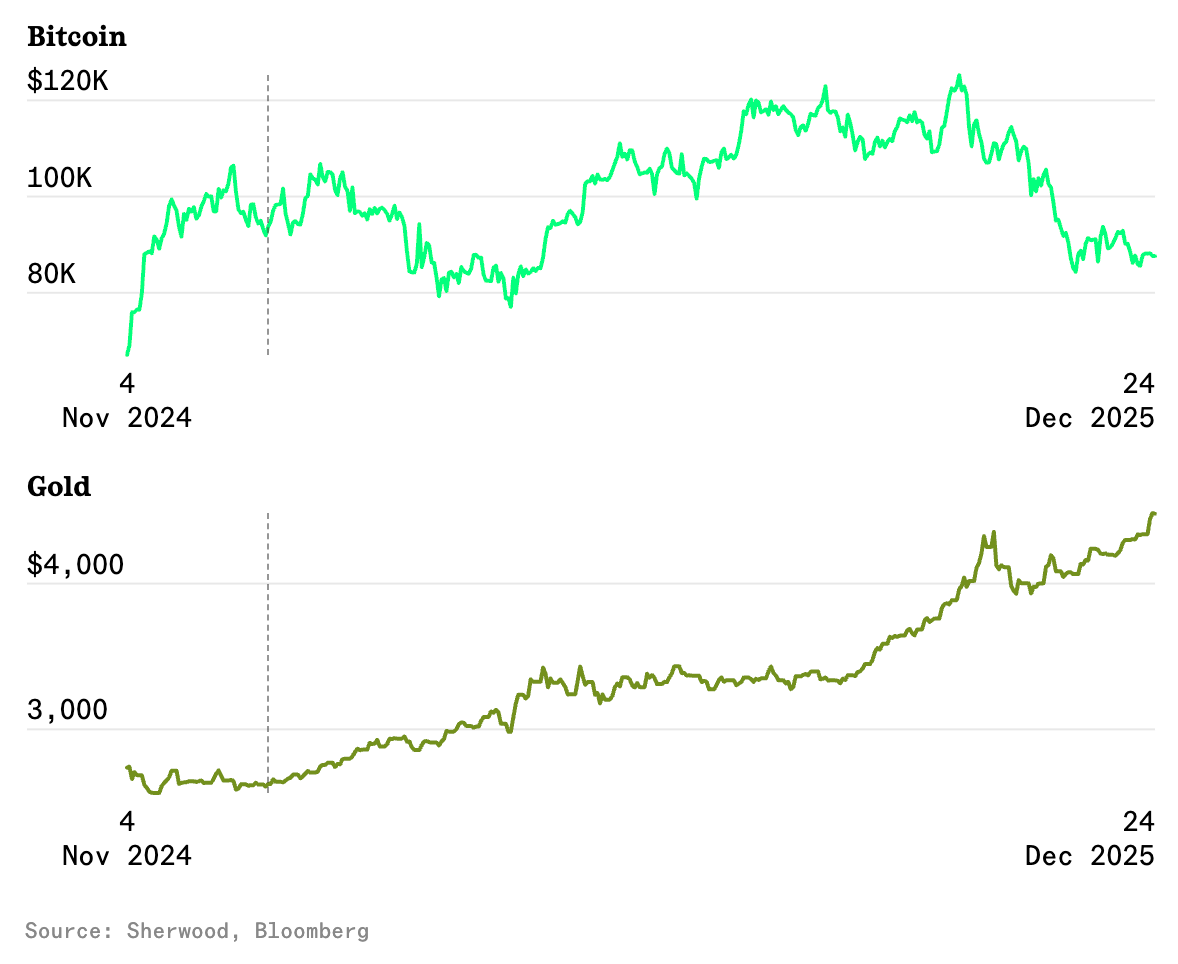

Gold is the strongest trend in global markets right now — and it’s not close.

The metal hasn’t traded below its 200-day moving average since November 2023 and currently sits roughly 25% above that level.

❗That line tends to separate assets being steadily accumulated from those still fighting for conviction — and gold has stayed firmly on the right side of it.

Not the S&P 500. Not the Nasdaq 100. Not even Nvidia can claim a streak that clean.

Bitcoin — often labeled “digital gold” — tells the opposite story.

In Q4, bitcoin is trading 20% below its 200-day moving average for the first time since Q4 2022 — a sharp divergence at a time when equities continue to grind higher.

That gap is worth paying attention to.

THE BREAKDOWN:

1) Why This Is Unusual

Bitcoin has historically been one of the market’s cleanest gauges of speculative appetite. When risk-taking accelerates, bitcoin usually feels it first — and most aggressively.

That’s what makes 2025 puzzling.

→ Unprofitable equities are still drawing interest.

→ Call buying remains active.

→ Equity indices continue to climb.

In fact, 2025 is on track to become the first year in more than a decade in which bitcoin underperforms gold while the S&P 500 rises.

That’s not typical behavior for an asset that’s supposed to sit at the intersection of risk, liquidity, and momentum.

2) The Timing Angle

The bitcoin-to-gold ratio adds another wrinkle.

That ratio peaked:

→ at its 2025 high the session after President Trump’s inauguration

→ and at an all-time high between the election and his return to office

The idea that a “crypto president” sparked a classic sell-the-news dynamic isn’t far-fetched — especially given the lack of clear fundamental catalysts behind bitcoin’s recent price swings.

That pattern has appeared before in markets driven by political anticipation.

3) The Ratio Tells the Cleaner Story

Strip out the dollar, and the picture sharpens.

At its peak, one bitcoin bought more than 40 troy ounces of gold.

Today, it buys less than half that amount.

That’s not just a price move — it’s a shift in relative conviction.

Watching this ratio into 2026 may help answer a bigger question:

Has bitcoin’s relationship with risk assets changed in a lasting way, or is this simply payback for outsized gains booked ahead of the 2024 election?

4) What Gold Is Signaling

Gold’s strength isn’t coming from a single source.

The move has been reinforced by:

retail traders riding momentum

systematic strategies owning what’s trending

sustained central-bank buying

Trends built on that kind of breadth don’t usually fade quietly.

Historically, gold has only exceeded its current streak above the 200-day moving average once since 1975 — a run that ended in 2011.

That period coincided with intermediate bottoms in housing and banking stocks, years after the financial crisis recession officially ended.

The lesson isn’t that history will repeat — it’s that gold trends of this magnitude tend to reflect deeper macro undercurrents, not passing sentiment.

5) What to Watch Next

Going forward, three things matter:

Does the bitcoin-to-gold ratio stabilize or keep sliding?

Does bitcoin re-attach itself to broader risk behavior?

Does gold’s trend finally crack — and if so, why?

Right now, gold is acting like a macro signal.

Bitcoin is acting like a risk asset searching for its footing.

That divergence won’t stay ignored forever.

THE TAKEAWAY:

It’s Complicated…

Gold and “digital gold” are no longer moving in sync.

Whether this gap reflects a temporary dislocation or a more durable shift in how markets perceive “digital gold” remains an open question — but one worth watching closely.

When assets that typically move together diverge, it’s rarely accidental.

LESSON OF THE DAY:

Reading the 200-Day Moving Average

Moving averages aren’t about calling tops or bottoms.

They’re about understanding what the market is doing.

The 200-day moving average acts as a long-term filter. It smooths out short-term noise and shows where price has spent most of the past year.

→ Above it, assets tend to attract steady participation. Pullbacks are bought. Trends are given time to work.

→ Below it, confidence weakens. Rallies need a catalyst to stick, and momentum becomes harder to sustain.

That’s why the 200-day is often used as a rough dividing line between bull and bear regimes — not as a prediction, but as a read on current behavior.

Shorter moving averages help with timing.

The 200-day provides context.

💬 We Want To Hear Your Story:

Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

Was this email forwarded to you? Don’t miss out on future stories — subscribe to the TradingLessons and get our daily market breakdown delivered straight to your inbox.

❗ P.S. – If you no longer want to receive occasional emails from us and you want to unsubscribe, scroll to the bottom of this email and click the “Unsubscribe” link located right under the disclaimer 👇