.

2026 Opened From the Ground Up

Happy New Year! 🎉✨🥂

Don’t forget to cast your vote 👇

If you only read headlines today, the moves looked familiar.

❗If you looked under the surface, they weren’t.

At the index level, the S&P 500 snapped its losing streak, helped by strength in semiconductors and energy, while the Nasdaq lagged and small caps outperformed. Crypto joined the risk-on tone, with bitcoin and higher-beta tokens moving higher.

But the more important signal wasn’t that AI stocks rose — it was where the gains concentrated. Hardware, memory, and infrastructure names led, while software, hyperscalers, and downstream AI plays lagged. Same theme, very different outcomes.

That split is the thread running through today’s tape.

In short: AI “worked,” but not everywhere. Retail “won,” but not by accident. Let’s break it down.

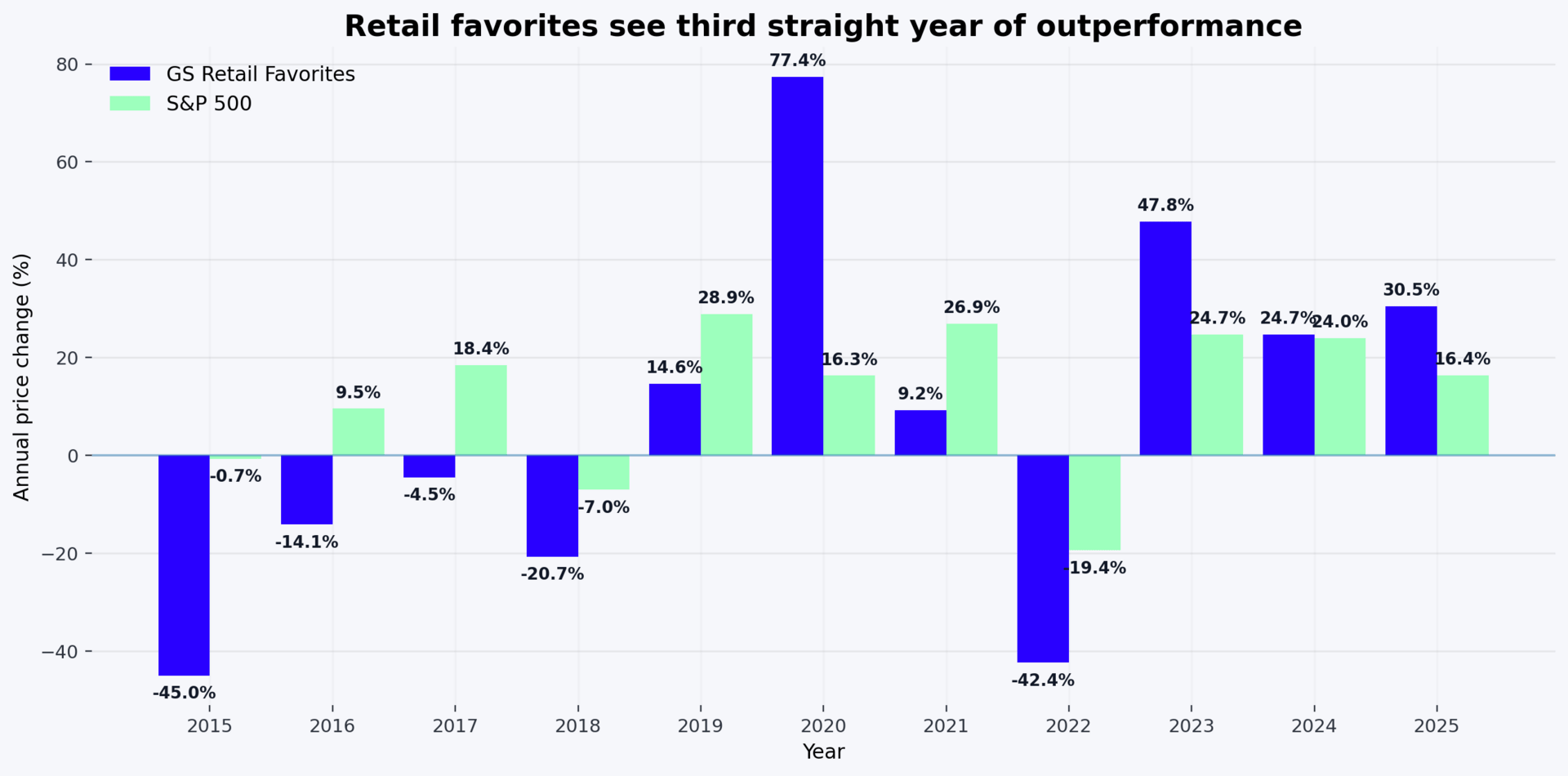

Retail Traders Beat the Market — Again

Retail traders closed 2025 with another strong year, outperforming the broader market for the third year in a row. By multiple measures, recent results don’t line up with the old “dumb money” label.

The data is straightforward:

→ Interactive Brokers clients averaged +19.2%, ahead of the S&P 500’s +17.9%

→ Goldman Sachs’ retail-favorites basket rose +30.5%, nearly double the index

→ JPMorgan data showed retail outperformance driven by tech, AI, and precious metals exposure

It’s easy to frame this as better timing or sharper instincts, especially after retail traders leaned into volatility during last year’s tariff-driven selloff.

But that’s not the real story.

❝ The Lesson ❞ : Retail portfolios were tilted toward higher-beta assets — stocks that move more than the market.

→ When the market rises, these stocks usually rise by a larger percentage

→ When the market falls, they typically decline more sharply

→ Heavy exposure to AI leaders, tech megacaps, and metals amplified gains in an up year

This kind of positioning doesn’t depend on superior forecasting. It depends on being aligned with market direction. In 2025, the market trended higher, and portfolios tilted toward more volatile names benefited mechanically from that move.

That reframes the result. Retail outperformance was real, but it was driven by risk concentration that happened to pay off, not a structural edge that works in all conditions. The same setup would have produced very different outcomes in a sustained drawdown.

Chips Pull Away

The first session of 2026 delivered a rare split inside tech.

→ Semiconductors (SMH) jumped +3.7%

→ Software (IGV) fell –2.9%

→ The 6.6-point gap was the largest on record, going back to 2011

That’s unusual because these two usually move together. Their rolling one-year correlation was near 0.8 coming into the day.

This time, it broke.

❝ The Lesson ❞: This wasn’t a tech call — it was a positioning shift inside AI.

→ Chips sit upstream in the AI stack: compute, data centers, infrastructure

→ Software sits downstream: applications, monetization, longer-dated payoffs

→ Early-year flows favored near-term certainty over future promise

A likely driver was internal rotation. Large funds appear to have kept overall AI exposure steady while leaning hardware-over-software as books reset for the year. Once that move started, momentum widened the gap quickly.

→ Hardware strength attracted buyers

→ Software weakness triggered trimming

→ Correlation broke, even within the same theme

This wasn’t a statement about AI peaking or software being “done.” It was a reminder that even within the same theme, markets constantly reprice where they want exposure.

The takeaway is structural, not emotional. AI didn’t lose favor. It just got more selective.

LESSON OF THE DAY:

💬 We Want To Hear Your Story:

Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

Was this email forwarded to you? Don’t miss out on future stories — subscribe to the TradingLessons and get our daily market breakdown delivered straight to your inbox.

❗ P.S. – If you no longer want to receive occasional emails from us and you want to unsubscribe, scroll to the bottom of this email and click the “Unsubscribe” link located right under the disclaimer 👇