.

$10K Gold by 2028: Realistic or Not?

Don’t forget to cast your vote 👇

Gold and silver just pushed to new all-time highs — again.

Gold broke $4,450/oz for the first time.

Silver surged to a record near $69/oz.

And they did it without a clean catalyst. There is:

No equity crash.

No dollar collapse.

No panic trade.

Usually:

Risk-on → Metals up.

Now:

Risk-off → Metals up, again!

So what’s actually going on?

Let’s break down why almost everything has become bullish for precious metals.

THE BREAKDOWN:

1) Gold Is No Longer Trading a Single Trigger

Gold used to move on one signal: fear.

In 2025, that framework stopped working.

This morning is a clean example. Risk assets are behaving normally:

Markets are positive.

Risk assets are leading.

The dollar is steady.

None of that signals stress. Yet gold pushed higher anyway.

The reason is simple: the marginal buyer has changed.

Gold is now being supported by overlapping sources of demand:

Central banks continue to add exposure.

Macro investors are positioning for easier policy.

Systematic traders stay long as long as price holds.

Different timeframes. Same direction.

That’s why gold has been able to perform across environments that would normally conflict with one another.

When demand comes from multiple sources, price doesn’t wait for a trigger.

It moves until something removes that demand.

So far, nothing has.

2) Trend Has Taken Control of Positioning

Gold’s price action has crossed an important threshold.

Over the past year, it has closed above its 50-day moving average in about 89% of sessions — the most persistent stretch since 1980.

That matters because the 50-day isn’t a story level. It’s a positioning level.

When price stays above it:

trend-following systems remain allocated

volatility-targeted funds don’t need to cut exposure

discretionary traders stop pressing shorts on pullbacks

The result is fewer sellers. With less pressure to unwind positions, pullbacks don’t trigger exits — they attract re-entry. Dips get bought faster, and rallies last longer.

Once positioning is tied to trend instead of headlines, price reinforces itself.

Moves persist not because the narrative improved — but because nothing forces exposure out.

3) Retail + ETF Flows Turned Gold Into a Trade

This year, large inflows into bullion-backed ETFs changed how gold trades.

Those flows don’t just express long-term hedging. They introduce shorter-term, price-sensitive demand — the kind that responds to trend and performance.

As a result:

momentum traders participate when price breaks higher

pullbacks attract dip-buyers rather than sellers

rallies reinforce positioning as exposure builds

That shifts gold’s role in portfolios.

Gold didn’t lose its safe-haven function.

It gained a speculative layer on top of it.

That’s why gold can rise alongside equities during risk-on periods, and still catch a bid when markets turn defensive.

4) Central Banks Keep the Floor Firm

While market flows swing, one buyer stays consistent: central banks.

Official-sector purchases aren’t tactical trades. They’re balance-sheet decisions. That makes them price-insensitive and persistent.

That steady demand does three things:

it absorbs supply during pullbacks

it limits downside volatility when sentiment softens

it anchors expectations for long-term support

As a result, dips find buyers sooner and selloffs lose momentum.

When a reliable buyer steps in regardless of market tone, the marginal seller disappears.

And when selling pressure thins, trends don’t just hold — they extend.

5) Silver Gets the High-Beta Version

Silver didn’t just follow gold. It outperformed.

Why? That’s because silver sits at the intersection of macro demand and real-world usage.

Three forces are doing the work:

Persistent supply deficits, which leave little buffer when demand rises

Industrial demand >50% of global consumption and ties silver to growth expectations

Heavy speculative positioning

That combination turned silver into the leveraged play on the same macro forces.

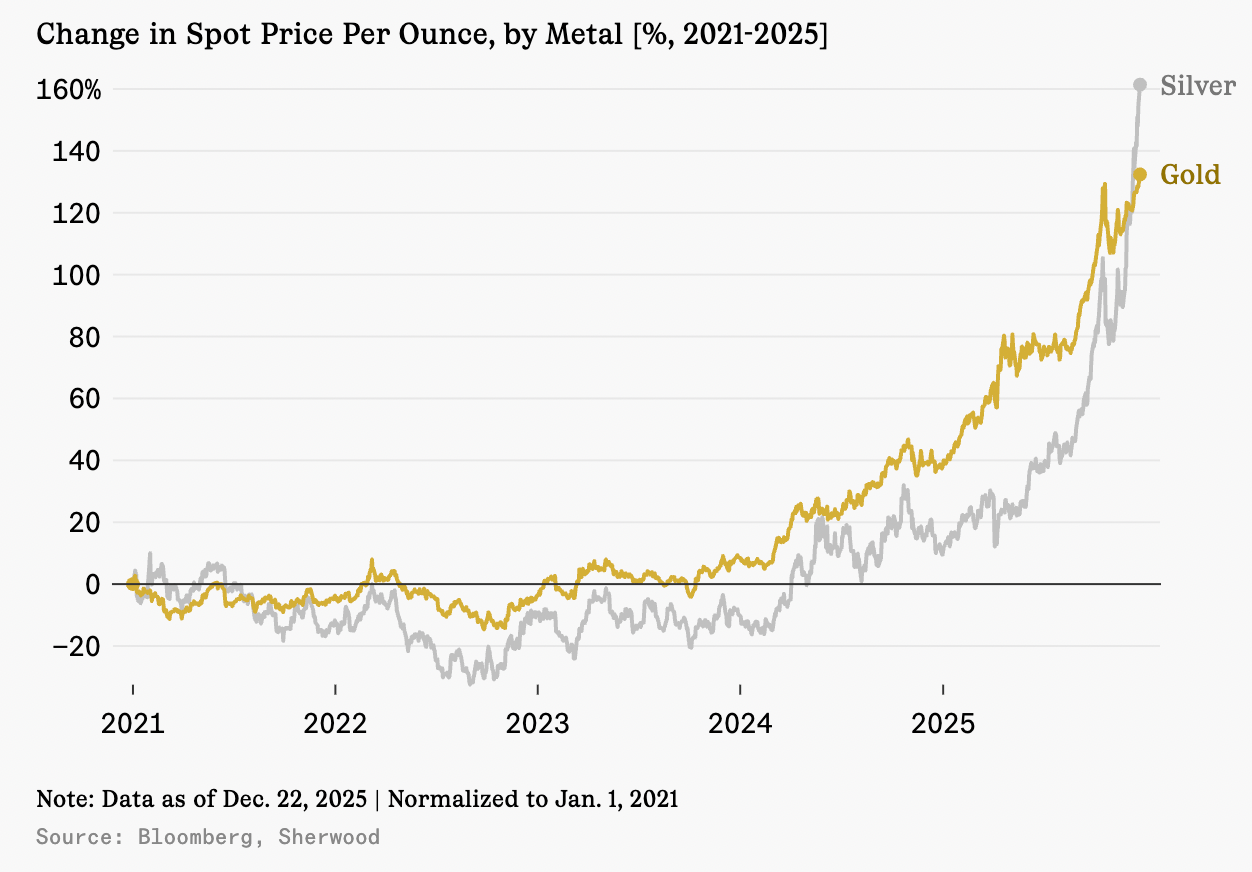

2025 performance:

Gold: +67% YTD

Silver: +138% YTD

Same theme. Different torque.

6) Rate Cuts Add Fuel

Markets are now pricing two US rate cuts in 2026. That shift matters less as a trigger and more as reinforcement.

Lower expected rates:

reduce the opportunity cost of holding metals

weaken the relative appeal of cash and short-duration bonds

allow existing trends to persist longer without policy resistance

The rate expectations didn’t start the move. Gold and silver were already trending higher. What cuts do is remove friction. They make it easier for capital to stay allocated and harder for the trade to get challenged by yields.

That’s why policy easing doesn’t explain why the rally began — but it does explain why it’s been allowed to continue.

THE TAKEAWAY:

Support Came From Everywhere

Gold and silver are rising because the market has stopped testing them.

Sellers aren’t pressing, dips aren’t forcing exits, and hedges are being added without unwinding risk elsewhere.

That changes how the move behaves:

pullbacks stay shallow

breakouts hold

time, not news, does the work

The trade doesn’t need a headline to move higher. It only needs yields to stay contained and buyers to stay patient.

Until something forces capital out, metals don’t need a reason. They move by default.

LESSON OF THE DAY:

💬 We Want To Hear Your Story:

Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

Was this email forwarded to you? Don’t miss out on future stories — subscribe to the TradingLessons and get our daily market breakdown delivered straight to your inbox.

❗ P.S. – If you no longer want to receive occasional emails from us and you want to unsubscribe, scroll to the bottom of this email and click the “Unsubscribe” link located right under the disclaimer 👇