.

It’s Not a Bubble Yet.

Hope you enjoyed the holidays and are settling back in.🎄 🍽️ 🙂

Don’t forget to cast your vote 👇

If this really is an AI bubble, it’s still missing a key ingredient: inflation in expectations.

What it’s not:

→ Not CPI Higher prices for goods and services — a macro issue, not a bubble trigger.

→ Not wages Labor cost pressure that hits margins, but doesn’t usually end asset booms.

What it is:

→ Narrative inflation The slow shift from “will this pay off?” to “of course this pays off.”

How bubbles actually form???

Historically, asset bubbles don’t peak just because capital spending accelerates. Large investment cycles can run for years without breaking markets, especially when the payoff is still uncertain and debated.

The turning point?

You’d see it in valuations first.

That’s usually how these things end — not with spending slowing, but with prices getting ahead of any believable outcome.

❗AI hasn’t reached that stage yet.

→ There’s still argument in the numbers.

→ Still friction in the assumptions.

→ Still doubt doing real work.

And until that changes, the bubble case remains unfinished.

THE BREAKDOWN:

Why the AI Trade Still Doesn’t Look “Late-Cycle”

If this period gets labeled in hindsight, it will probably read as a hybrid rather than a clean bubble.

→ An earnings illusion

Short-term profit strength helped by timing, accounting, or credit effects.

→ A valuation expansion

Multiples rising on future promises rather than current cash flow.

That setup echoes the late ’90s.

The problem for the “AI already peaked” argument is timing. If this were truly the end, markets would already look like 2000. Instead, behavior still resembles 1996 — when the infrastructure was being built, skepticism still existed, and excess was discussed more than it was expressed.

Bank of America’s equity derivatives team put it plainly: avoiding an AI bubble may be unlikely, but the core trade still appears to have room to run into 2026.

That’s not euphoria.

It’s excess being anticipated — not realized.

And until behavior changes, calling this late-cycle remains premature.

The Fed Model Tells a Quiet Story

The old “Fed model” — comparing equity earnings yield to bond yields — still isn’t flashing dot-com levels of irrationality.

Today’s reading:

→ ~0.35% nominal, 2.6% real

Dot-com extremes:

→ −2.75% nominal, −0.4% real

Lower readings mean investors are choosing risk over safety.

We’re not there.

Translation:

Risk appetite is elevated — not unhinged.

On the Surface, the Math Still Behaves

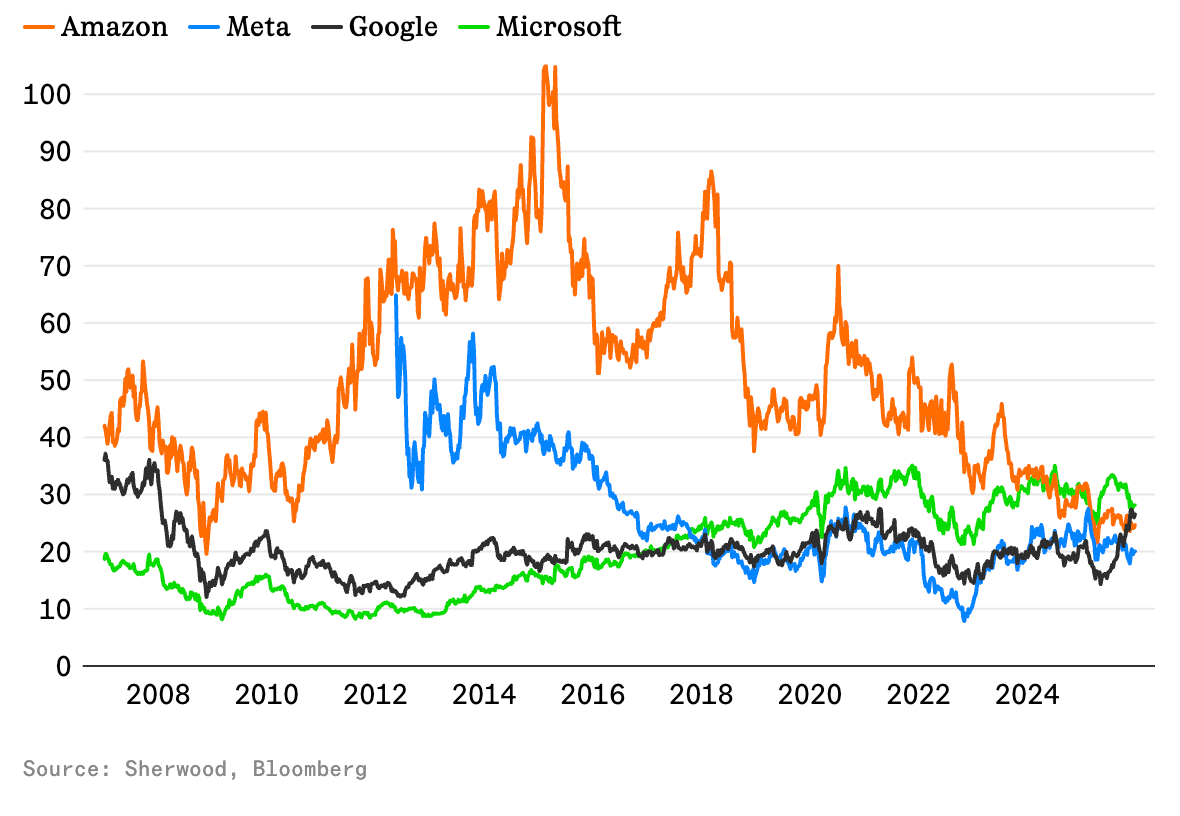

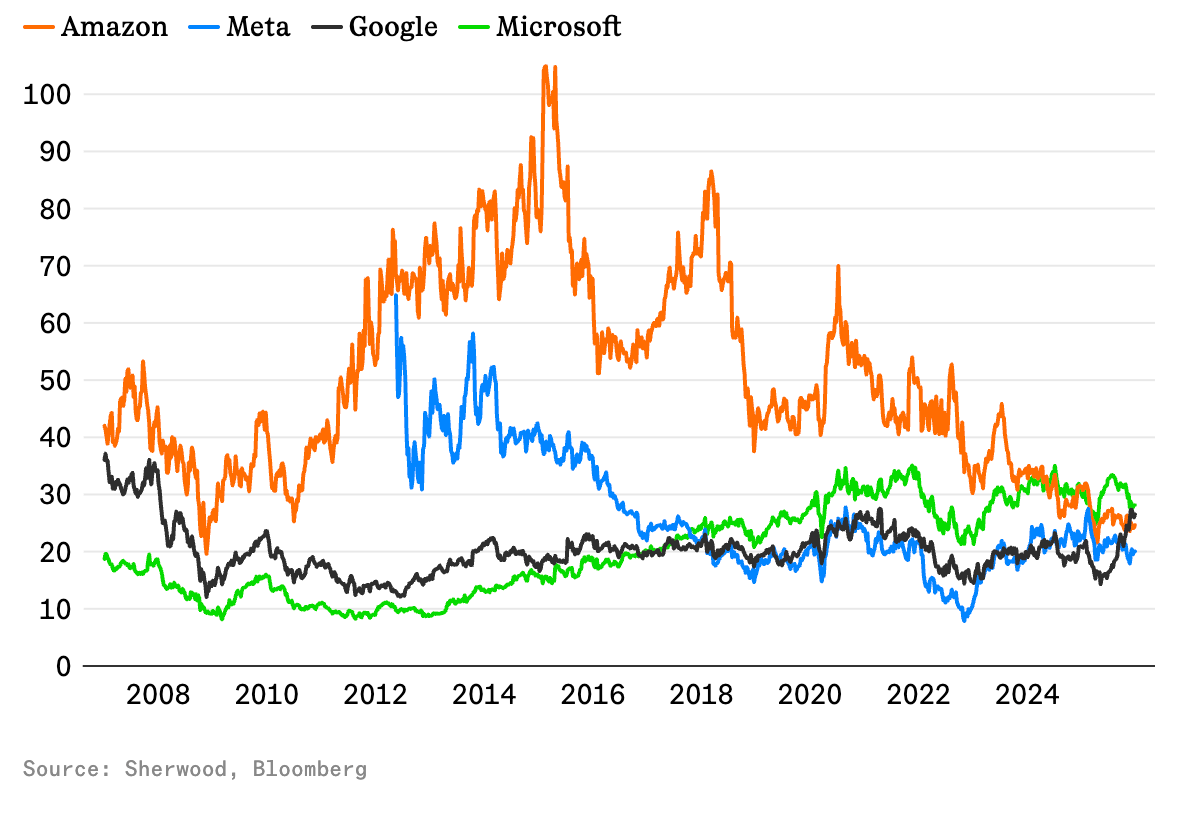

None of the hyperscalers are trading anywhere close to the kind of numbers that defined the dot-com peak.

Back then, Cisco Systems topped out north of 130× forward earnings — a level that only works if the future arrives immediately and flawlessly.

Today’s leaders don’t look like that.

By forward P/E:

Amazon

Meta

Alphabet

Microsoft

…are expensive, sure — but not detached from reality, either relative to their own history or to the broader S&P 500.

That’s the part that keeps the “this is just 2000 again” argument from sticking.

The Tension Shows Up Somewhere Else

Where things do start to stretch is free cash flow.

On that metric, most of these names are sitting at fresh valuation highs.

And that’s not a coincidence.

Capex is doing something awkward right now:

It drains cash immediately

But only hits earnings gradually, through depreciation

So on paper, profits look fine.

On the balance sheet, the money is already gone.

That disconnect is doing a lot of the market’s work right now.

The Real Question: Capex First, Profits Later

Right now, AI spending is doing two jobs at once:

Offensive

→ Building products and revenue streams that don’t exist yetDefensive

→ Preventing incumbents from being displaced

As Ryan Cummings (Stanford Institute for Economic Policymaking) points out, AI-related revenue is still being dwarfed by AI capex.

That’s not a red flag by itself — it’s typical for early-stage platforms.

But it does explain why markets haven’t gone full-bubble.

Skepticism still exists.

And skepticism keeps bubbles alive.

Spending Is Easy. Payoff Is the Question.

The market isn’t treating AI capex as a guaranteed win.

It’s treating it as a pending claim.

A bet that:

This spending turns into real products

Those products turn into revenue

And that revenue eventually justifies the scale of the buildout

Until that chain tightens, enthusiasm has a ceiling.

Which is why valuations feel stretched — but not unhinged.

Why Corporate Adoption Matters More Than Chips

Markets no longer reward AI spending for its own sake.

Investors want proof that AI is moving from: “We’re building it” → “People are using it”

That’s why some of the cleanest demand signals aren’t hyperscalers — they’re enablers.

Watching the Adoption Proxies

Two names matter here:

Accenture

A bellwether for whether corporations are actually paying to implement AI, not just talk about it.CEO Julie Sweet: “We are expanding in these partnerships because of what we see in client demand.”

Accenture refusing to break out AI revenue going forward is telling — management sees AI as core, not optional.

IBM

Where AI consulting feeds directly into software revenue.CEO Arvind Krishna: “AI is a big piece of why consulting is beginning to return to growth.”

If AI adoption stalls, these numbers will show it first.

THE TAKEAWAY:

This isn’t a bubble built on blind faith.

It’s a market suspended between:

Heavy spending

Unproven returns

Lingering doubt

And that doubt is doing something important:

keeping valuations in check — for now.

Real bubbles don’t pop because capex is too high.

They pop when everyone stops asking whether the returns will show up.

We’re not there yet.

That’s why the AI trade hasn’t peaked.

And that’s why, if history rhymes, there may still be air left to inflate it.

LESSON OF THE DAY:

Volume

Prices move constantly.

Volume tells you whether the market actually believes the move.

A rally on heavy volume signals conviction — broad participation backing higher prices.

A rally on light volume signals caution — fewer buyers, weaker follow-through.

That’s why volume matters most at key moments:

Breakouts without volume often fail

Trends without volume lose momentum

Reversals often begin when price keeps moving but volume doesn’t confirm it

Volume doesn’t predict direction.

It confirms — or questions — what price is already doing.

Translation:

Price shows what happened.

Volume tells you how much it mattered.

💬 We Want To Hear Your Story:

Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

Was this email forwarded to you? Don’t miss out on future stories — subscribe to the TradingLessons and get our daily market breakdown delivered straight to your inbox.

❗ P.S. – If you no longer want to receive occasional emails from us and you want to unsubscribe, scroll to the bottom of this email and click the “Unsubscribe” link located right under the disclaimer 👇