Archives: Posts

Don’t forget to cast your vote 👇 It is a Super Bowl Enigma. source: sherwood Last night, millions of people stared at “LX” and quietly Googled what it meant.

LX.

A quick refresher for anyone who needed it: L is 50, X is 10 — which makes Super Bowl LX simply Super Bowl 60.

The small lesson in that moment is useful: the things that look simple often aren’t.

Which brings us to today’s story:

So… about what happened in healthcare today.

While we were still digesting the Super Bowl weekend, Danish pharma giant Novo Nordisk sued Hims & Hers, accusing the telehealth company of infringing...

Tanya on .

AI-Layoff Excuse

Don’t forget to cast your vote 👇 So… about yesterday’s market.

After a week that felt held together with tape, Friday snapped back hard.

The Dow ripped past 50,000 for the first time ever.The S&P 500 jumped nearly 2%. The Nasdaq followed.

Big Tech led the bounce — Nvidia +8%, Broadcom up big, Tesla higher — even as Amazon sank on plans to spend even more on AI.

Crypto bounced too: Bitcoin climbed back above $70K after plumbing 16-month lows. Strategy (MSTR) whipsawed, then finished sharply higher.

On paper, it looked like “risk is back.”Underneath, it felt more like relief than conviction.

While...

Tanya on .

AI-Layoff Excuse

Don’t forget to cast your vote 👇 So… about yesterday’s market.

After a week that felt held together with tape, Friday snapped back hard.

The Dow ripped past 50,000 for the first time ever.The S&P 500 jumped nearly 2%. The Nasdaq followed.

Big Tech led the bounce — Nvidia +8%, Broadcom up big, Tesla higher — even as Amazon sank on plans to spend even more on AI.

Crypto bounced too: Bitcoin climbed back above $70K after plumbing 16-month lows. Strategy (MSTR) whipsawed, then finished sharply higher.

On paper, it looked like “risk is back.”Underneath, it felt more like relief than conviction.

While...

Tanya on .

Un-Magnificent Moment

Don’t forget to cast your vote 👇 Did you read yesterday’s edition? Bitcoin ( ▼ 13.05% ) was wobbling.Today… it slipped after Treasury Secretary Scott Bessent made it clear the government isn’t riding to the rescue — and crypto took the hint.

While everyone was staring at crypto, something slower — and arguably more important — was happening in the biggest stocks on Earth.

So let’s put Bitcoin on pause for 60 seconds.

Because today’s story isn’t about tokens.

It’s about the “Magnificent Seven.”

For years, “own the Mag 7” was the easiest trade in markets. It worked so well it stopped feeling...

Tanya on .

Bitcoin’s Quiet Problem

Don’t forget to cast your vote 👇 This one wasn’t on the bingo card.

A few months ago, the Bitcoin bear case sounded reasonable:Maybe we get a normal pullback. Maybe some chop. Nothing dramatic.

Well… here we are.

Bitcoin isn’t crashing in one violent move.It’s doing something more unsettling: slowly losing its footing.

That’s usually how trouble starts — with a quiet slide that makes everyone uncomfortable. The Spark That Started The Chain Back in November, Michael Purves flagged something most people brushed off: a monthly MACD sell signal.

MACD is basically a speedometer for the market....

Tanya on .

Beyond the Bullion

Don’t forget to cast your vote 👇 Gold and silver have been everywhere last week.

At this point, even my dog probably has a view on gold.

So before we all start seeing bullion in our dreams, let’s give the metals a quick timeout today.

We’re turning our head to two other stories that are just as interesting.

Enjoy reading. SpaceX Just Ate xAI This didn’t just get closer to a deal. It got closer to a public company.

Bloomberg first said SpaceX and xAI were in “advanced talks.”Now there’s an internal memo saying they’ve merged — with a target valuation around $1.25–$1.5 trillion.

On the...

Tanya on .

Metals Took a Hit. Is the Story Over?

Don’t forget to cast your vote 👇 Don’t worry — we noticed too.

We spent most of the week talking about gold.About silver.About why everyone suddenly cared again.

Which makes Friday’s move… inconvenient.

Gold and silver didn’t just pull back.They reset.

Gold briefly fell more than 10% intraday, its sharpest one-day drop since the 1980s — worse than its worst day during the 2008 financial crisis.Silver was hit harder, sliding nearly 30% at one point — its biggest percentage drop since 1980.

For assets known as safe havens, that’s uncomfortable.

But it’s also revealing. Gold’s Trade Just...

Tanya on .

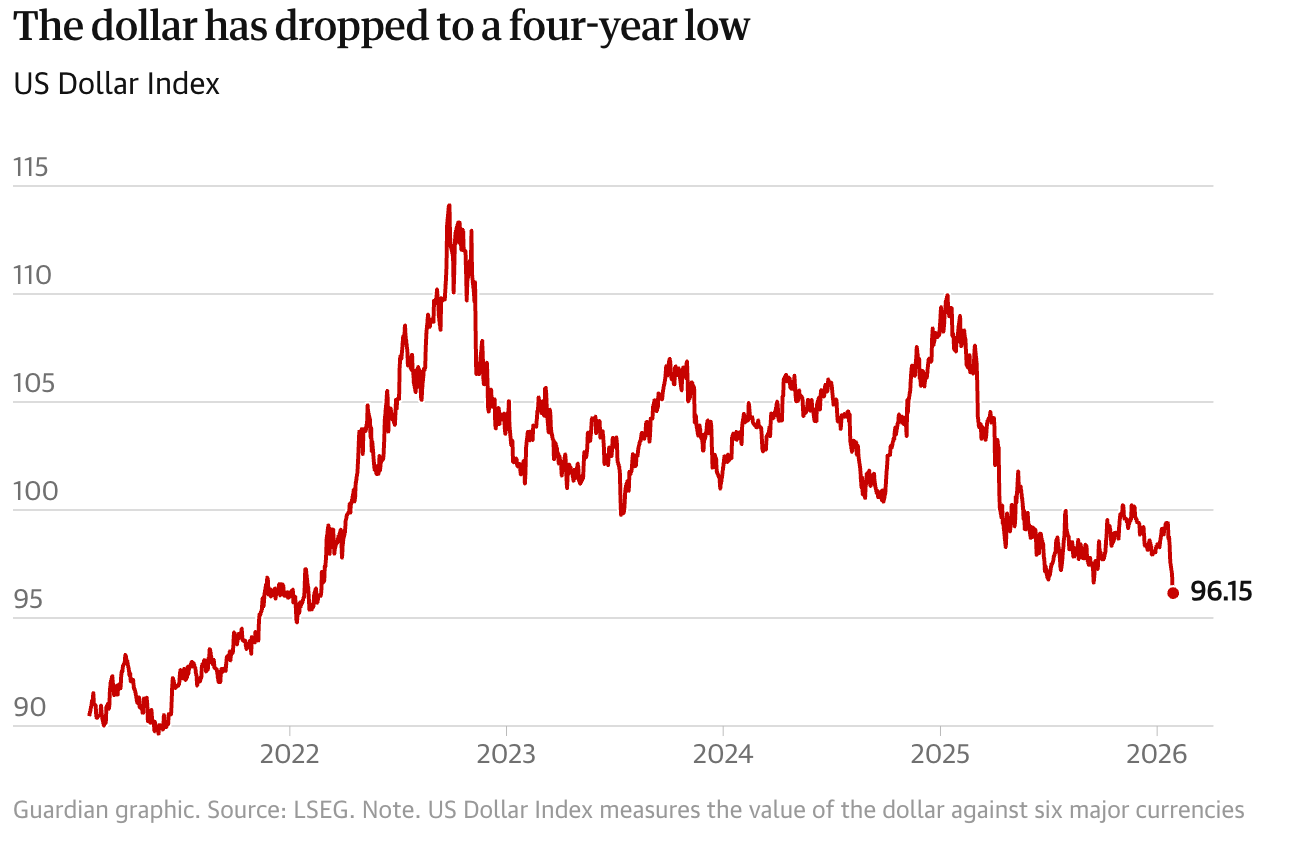

Weaker Dollar: The Hidden Math

Don’t forget to cast your vote 👇 Most days, the dollar sits quietly behind everything you buy, sell, invest, or save. It prices your coffee, your portfolio, your vacation, your oil, your gold — and then politely stays out of the spotlight.

Stocks move.Crypto swings.Commodities spike.

The dollar usually just… exists.

Which is why it’s worth paying attention when the dollar suddenly becomes the headline.

This week, the greenback dropped about 1.3% ▼ in a single session — its sharpest daily slide in months — and briefly touched levels not seen since early 2022. Over the past year, it’s now...

Tanya on .

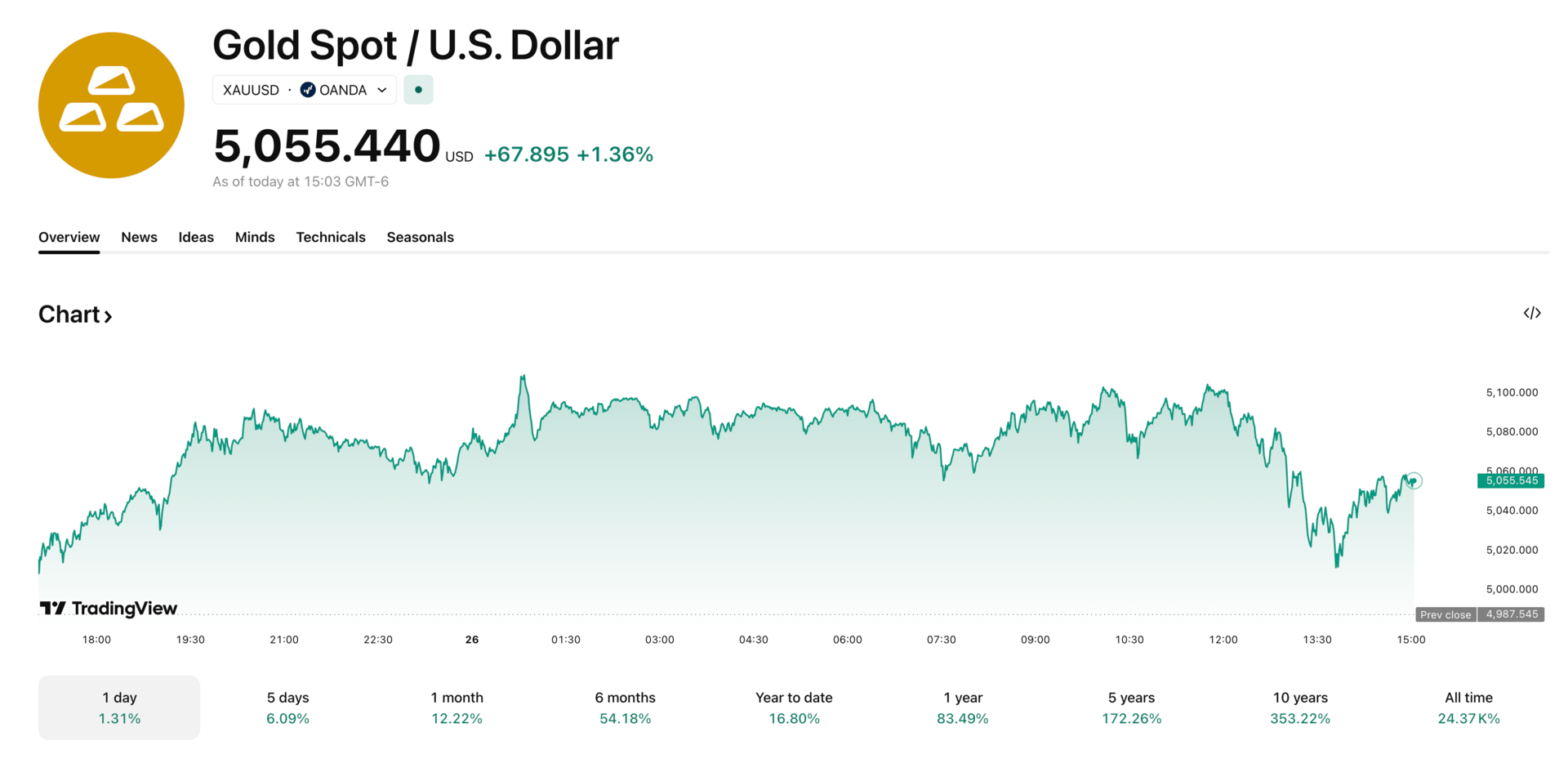

Everyone Is Buying Gold. But How?

Don’t forget to cast your vote 👇 The Question That Aged Faster Than Expected

Last week, we asked you a question:

When does gold hit $5,000?

About 25% of you said: “By the end of January.”

Which sounded bold.Possibly optimistic.Maybe even slightly unhinged.

Because today is January 26th.

That means one of two things is true:

→ Either a few of you own a very powerful crystal ball.→ Or the market just decided to move a lot faster than anyone expected.

Either way, the poll captured something real.

When one out of every four readers even entertains a move that sounded crazy a few weeks ago,...

Tanya on .

Is Gold Trying to Tell Us Something?

Don’t forget to cast your vote 👇 Nobody likes buying insurance.

It feels boring.It feels unnecessary.It feels like paying for something you hope you’ll never use.

You don’t wake up excited to buy homeowners insurance.You don’t brag to friends about your deductible strategy.You don’t refresh your insurance app during lunch.

Until the risk changes.

Then suddenly everyone wants coverage.

Markets treat gold the same way.

Gold isn’t an interest-bearing asset. It’s not supposed to be thrilling. It doesn’t invent anything, disrupt anything, or scale anything.

Gold is insurance against things going...

Tanya on .

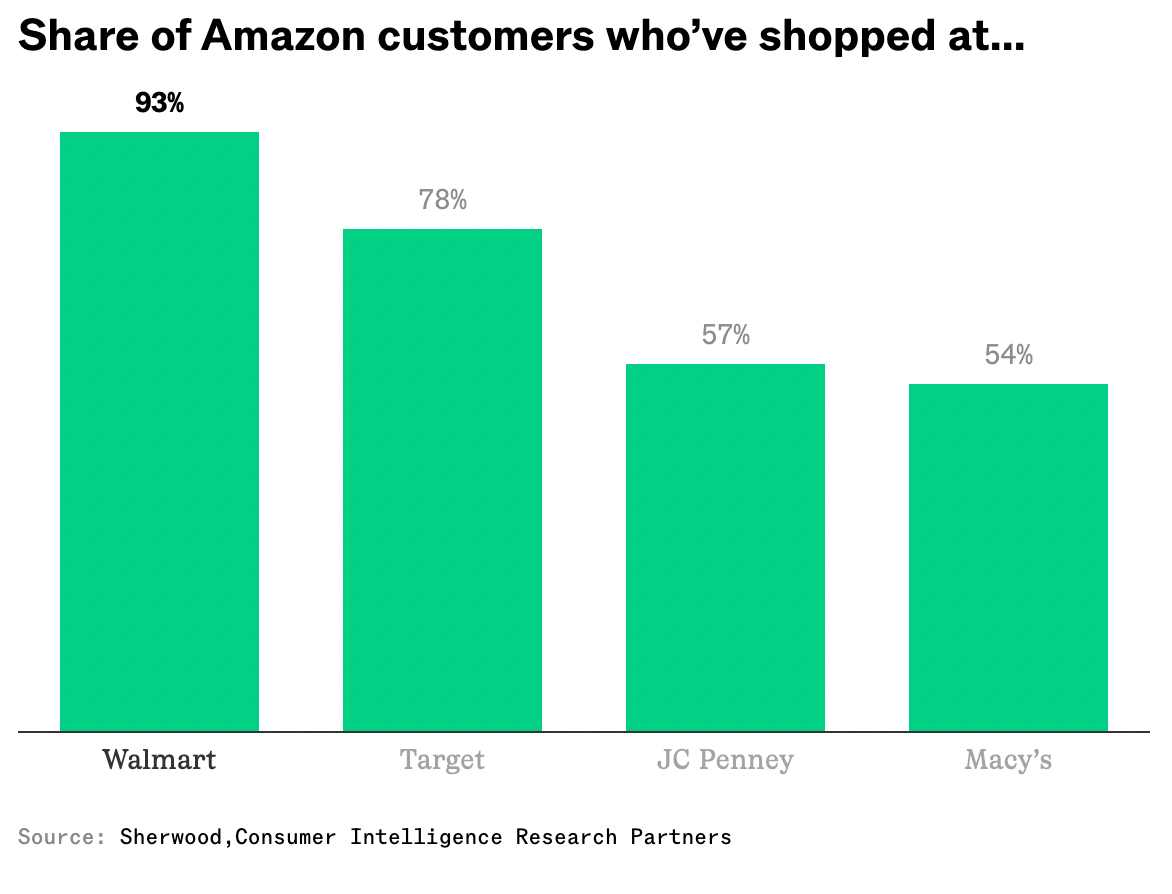

Retail Wars…

Don’t forget to cast your vote 👇 You probably think you choose where you shop.

In reality, your habits choose for you.

You don’t wake up and rationally analyze logistics networks, pricing algorithms, and supply chains before buying paper towels.

You open the app you always open. You drive to the store you always drive to. You click the button that feels easiest.

Convenience is a powerful drug.

And right now, three giants are fighting to become your default behavior.

Not your favorite store.

Your reflex. The Battlefield Retail used to be a simple trade:

→ Stores controlled shelves.→ Brands...

Tanya on .

Retail Wars…

Don’t forget to cast your vote 👇 You probably think you choose where you shop.

In reality, your habits choose for you.

You don’t wake up and rationally analyze logistics networks, pricing algorithms, and supply chains before buying paper towels.

You open the app you always open. You drive to the store you always drive to. You click the button that feels easiest.

Convenience is a powerful drug.

And right now, three giants are fighting to become your default behavior.

Not your favorite store.

Your reflex. The Battlefield Retail used to be a simple trade:

→ Stores controlled shelves.→ Brands...

Tanya on .

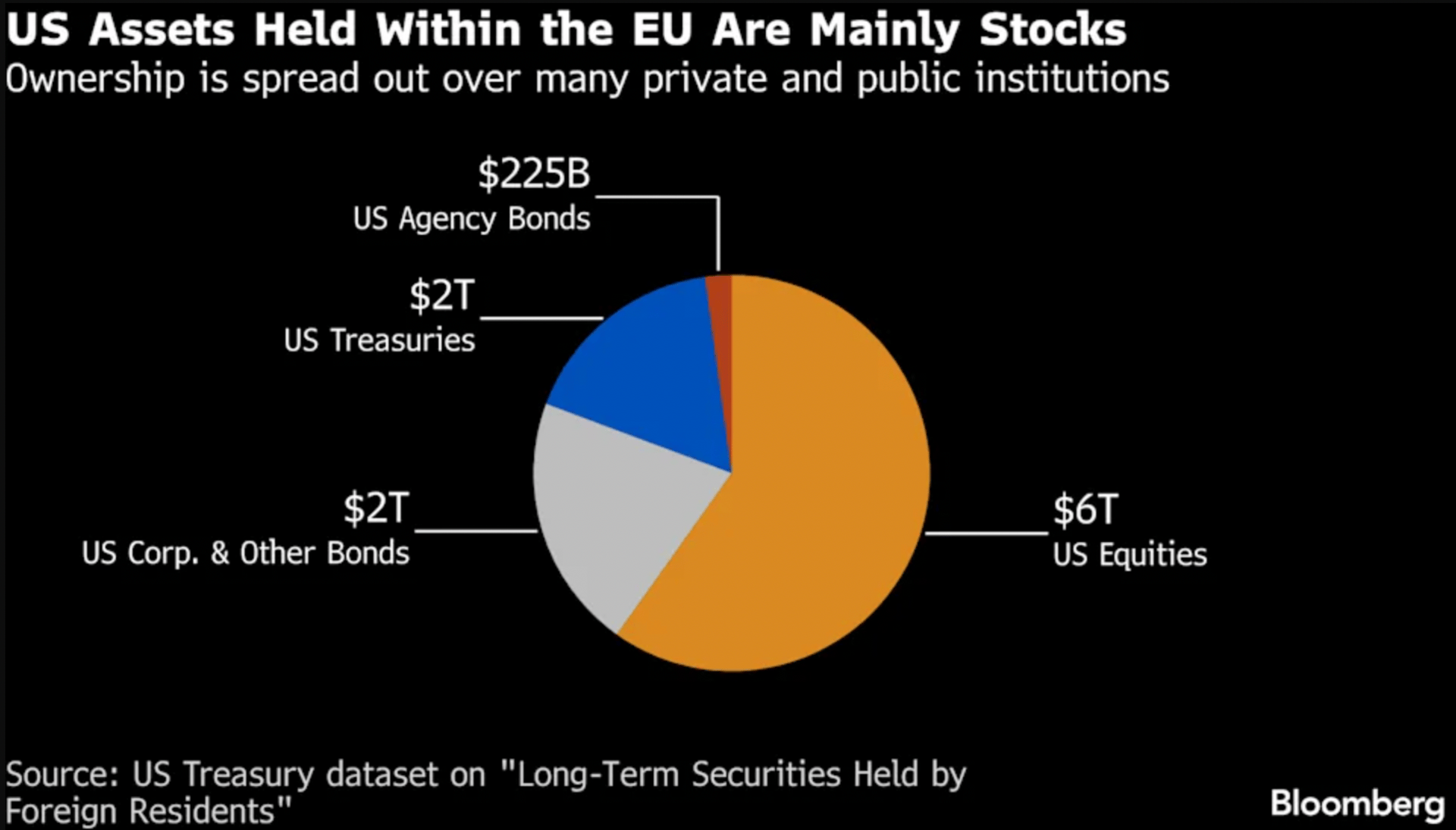

$10 Trillion “Oh Crap” Button in Global Markets

Don’t forget to cast your vote 👇 Over the weekend, President Trump floated new tariff threats against several European countries unless a deal is reached over Greenland.

Denmark. Germany. France. The UK. Norway. Sweden. Finland. The Netherlands.

Tariffs would start at 10% in February… and climb to 25% by summer if negotiations stall.

Markets didn’t love that.

European stocks slid.US futures dipped.Bitcoin fell.Gold and silver hit fresh all-time highs.

But here’s the part most people missed:

Europe isn’t just a trading partner.Europe is one of America’s biggest lenders.

And that gives them...

Tanya on .

The Quiet War Over Your Cash

Don’t forget to cast your vote 👇 Money has a personality. It depends on who’s holding it.

Some dollars like to sit still in one account.Some dollars like to wander between apps.Some dollars get bored easily and start hunting for a better couch to nap on.

If you’ve ever moved $200 from one account to another just because the interest rate looked slightly prettier… congratulations. You’ve participated in modern finance’s favorite sport:

Deposit hopping.

Banks used to rely on one simple truth:

Money is lazy.

Once your paycheck landed in a checking account, it basically stayed there forever....

Tanya on .

AI: Who’s Really In Charge? 🧠

Don’t forget to cast your vote 👇 Your brain is very good at one thing:

Trusting familiar patterns.

→ If a voice sounds right, you believe it.→ If a face looks real, you relax.→ If a message feels official, you comply.

That wiring worked great when the biggest threat was a raccoon stealing your trash.

It works a lot less well when a machine can generate a perfect human voice in three seconds, clone a face in five, and send you a fake “support” message before you finish your coffee.

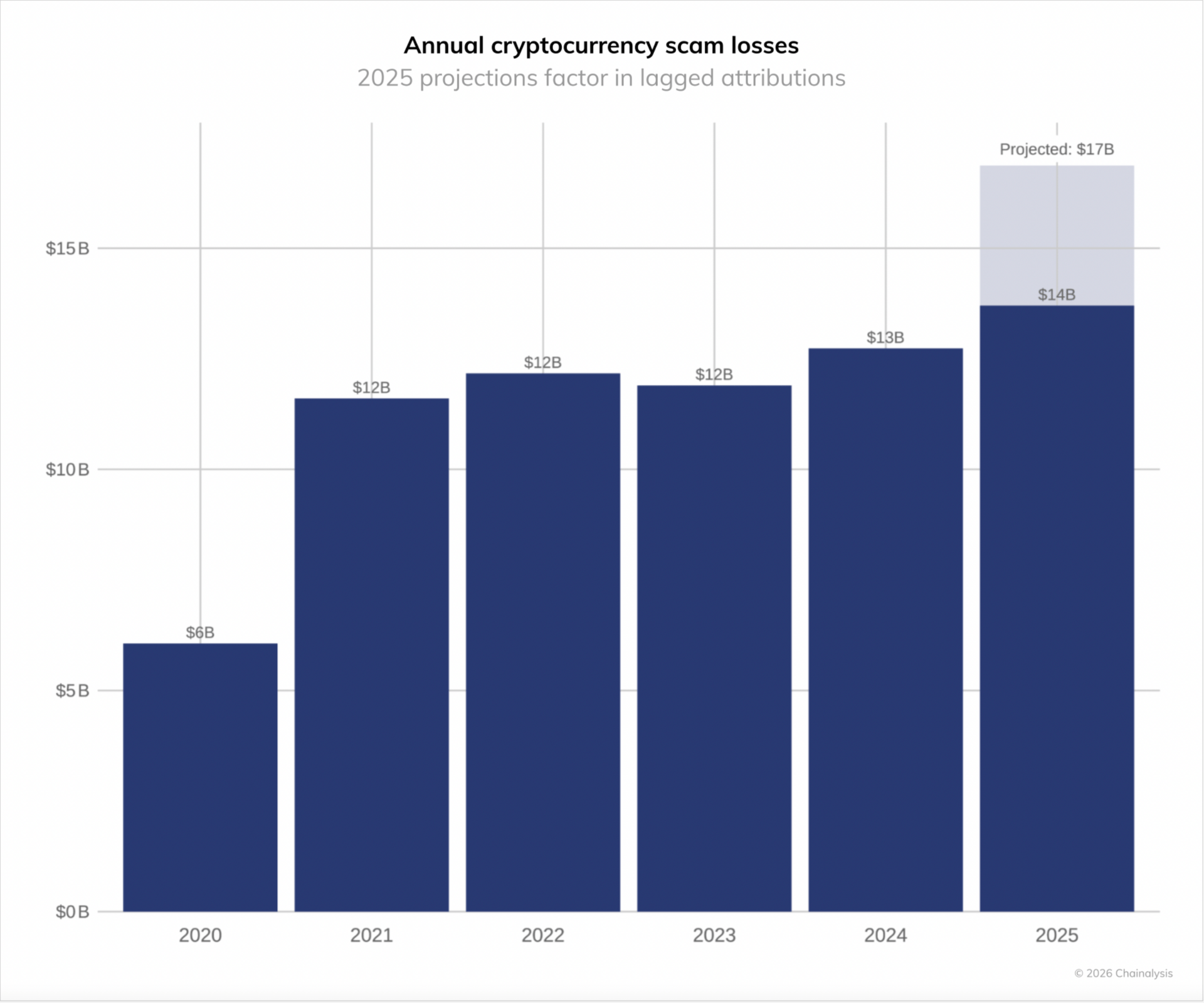

Which might explain why scammers just pulled off their most profitable year ever.

But the scams are just the...

All Rights Reserved © 2025 Trading Lessons