Author: Tanya

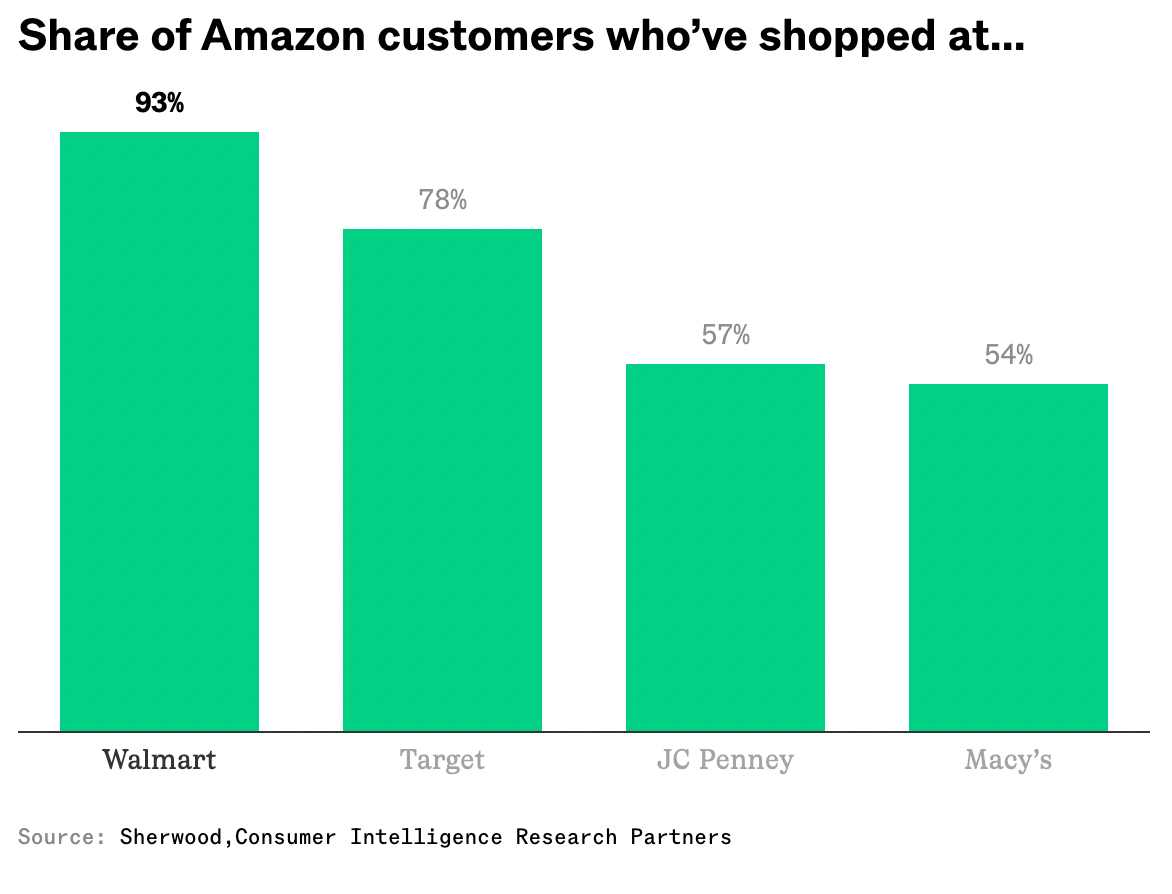

Don’t forget to cast your vote 👇 You probably think you choose where you shop.

In reality, your habits choose for you.

You don’t wake up and rationally analyze logistics networks, pricing algorithms, and supply chains before buying paper towels.

You open the app you always open. You drive to the store you always drive to. You click the button that feels easiest.

Convenience is a powerful drug.

And right now, three giants are fighting to become your default behavior.

Not your favorite store.

Your reflex. The Battlefield Retail used to be a simple trade:

→ Stores controlled shelves.→ Brands...

Tanya on .

Retail Wars…

Don’t forget to cast your vote 👇 You probably think you choose where you shop.

In reality, your habits choose for you.

You don’t wake up and rationally analyze logistics networks, pricing algorithms, and supply chains before buying paper towels.

You open the app you always open. You drive to the store you always drive to. You click the button that feels easiest.

Convenience is a powerful drug.

And right now, three giants are fighting to become your default behavior.

Not your favorite store.

Your reflex. The Battlefield Retail used to be a simple trade:

→ Stores controlled shelves.→ Brands...

Tanya on .

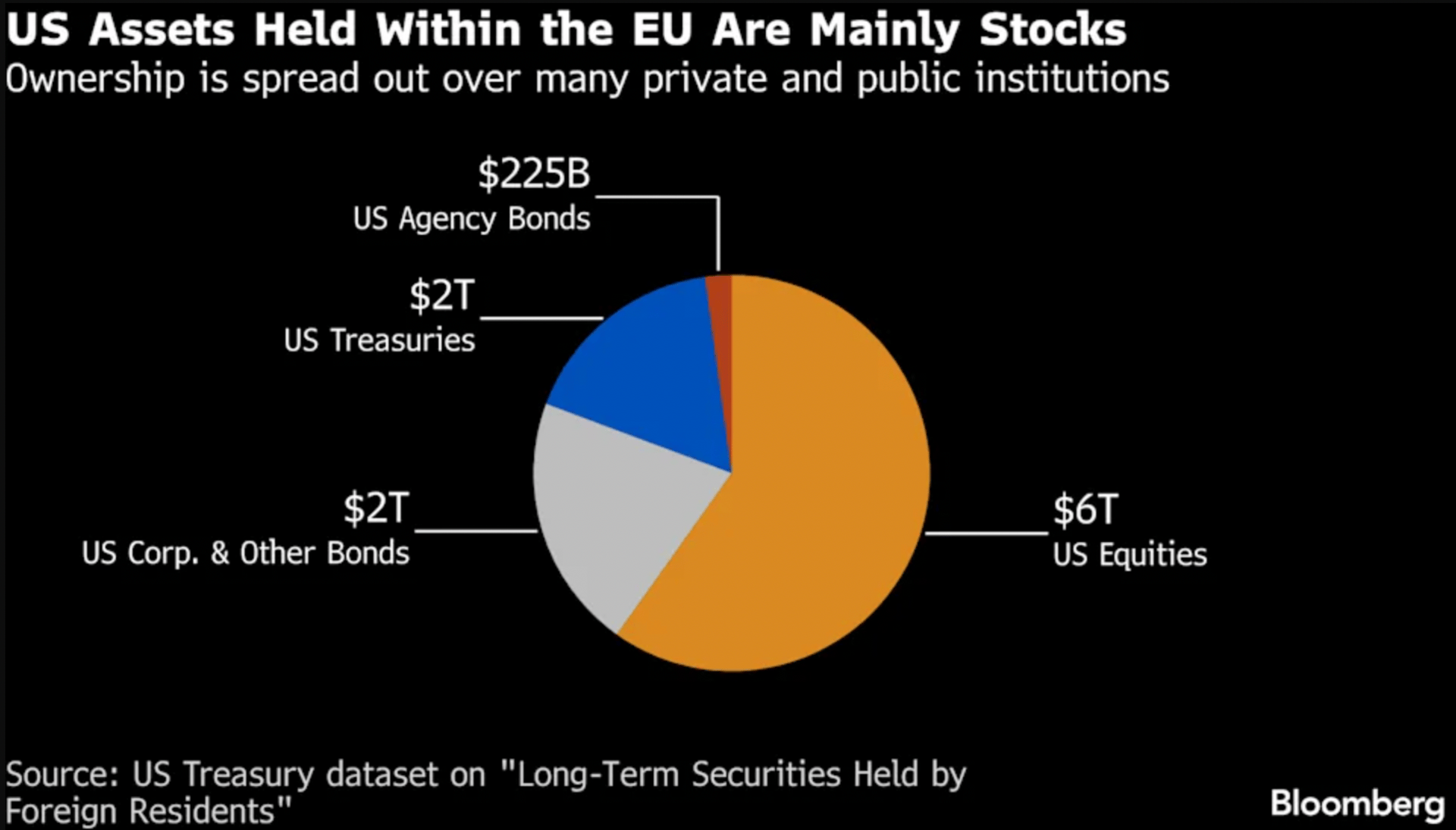

$10 Trillion “Oh Crap” Button in Global Markets

Don’t forget to cast your vote 👇 Over the weekend, President Trump floated new tariff threats against several European countries unless a deal is reached over Greenland.

Denmark. Germany. France. The UK. Norway. Sweden. Finland. The Netherlands.

Tariffs would start at 10% in February… and climb to 25% by summer if negotiations stall.

Markets didn’t love that.

European stocks slid.US futures dipped.Bitcoin fell.Gold and silver hit fresh all-time highs.

But here’s the part most people missed:

Europe isn’t just a trading partner.Europe is one of America’s biggest lenders.

And that gives them...

Tanya on .

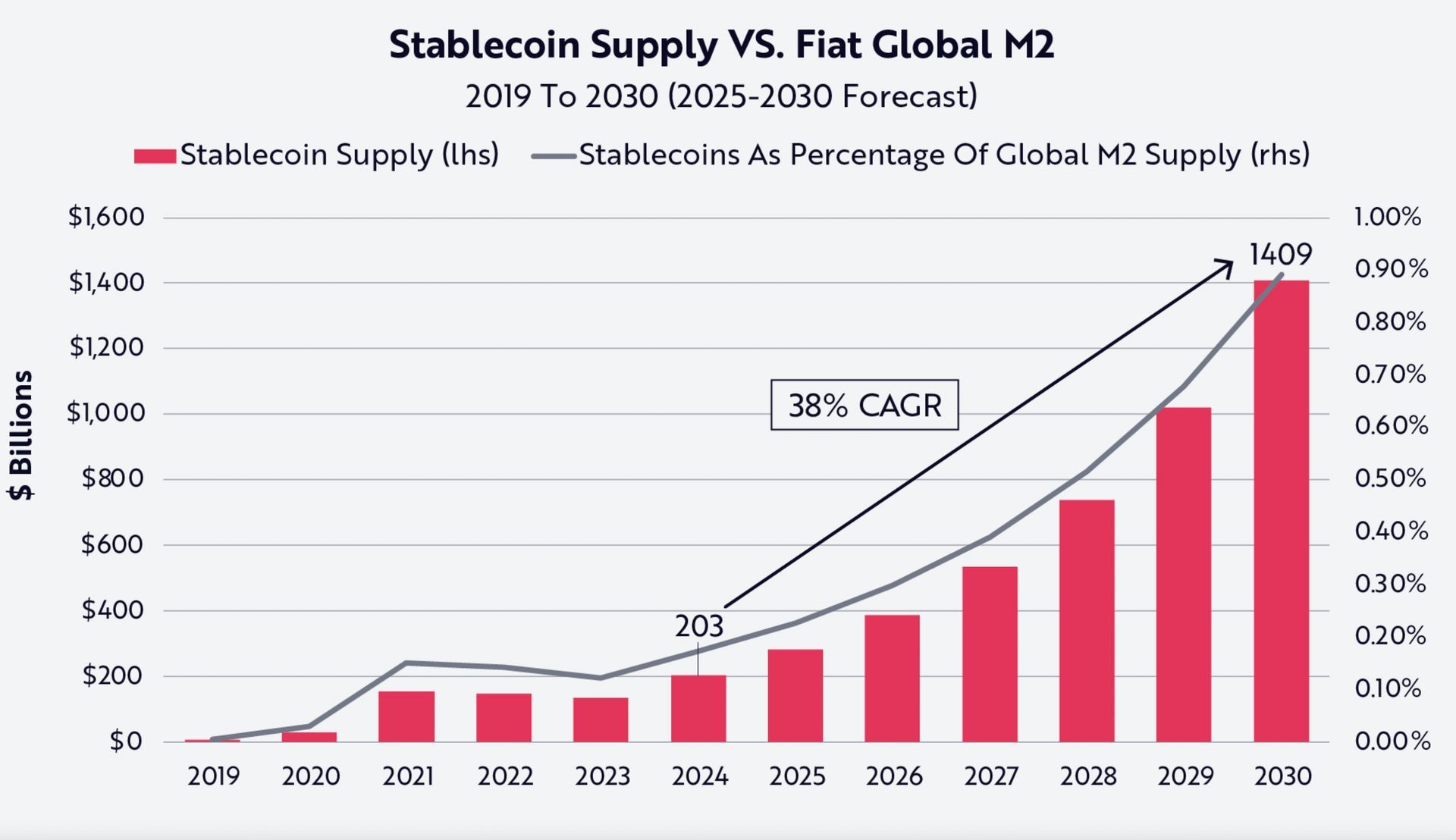

The Quiet War Over Your Cash

Don’t forget to cast your vote 👇 Money has a personality. It depends on who’s holding it.

Some dollars like to sit still in one account.Some dollars like to wander between apps.Some dollars get bored easily and start hunting for a better couch to nap on.

If you’ve ever moved $200 from one account to another just because the interest rate looked slightly prettier… congratulations. You’ve participated in modern finance’s favorite sport:

Deposit hopping.

Banks used to rely on one simple truth:

Money is lazy.

Once your paycheck landed in a checking account, it basically stayed there forever....

Tanya on .

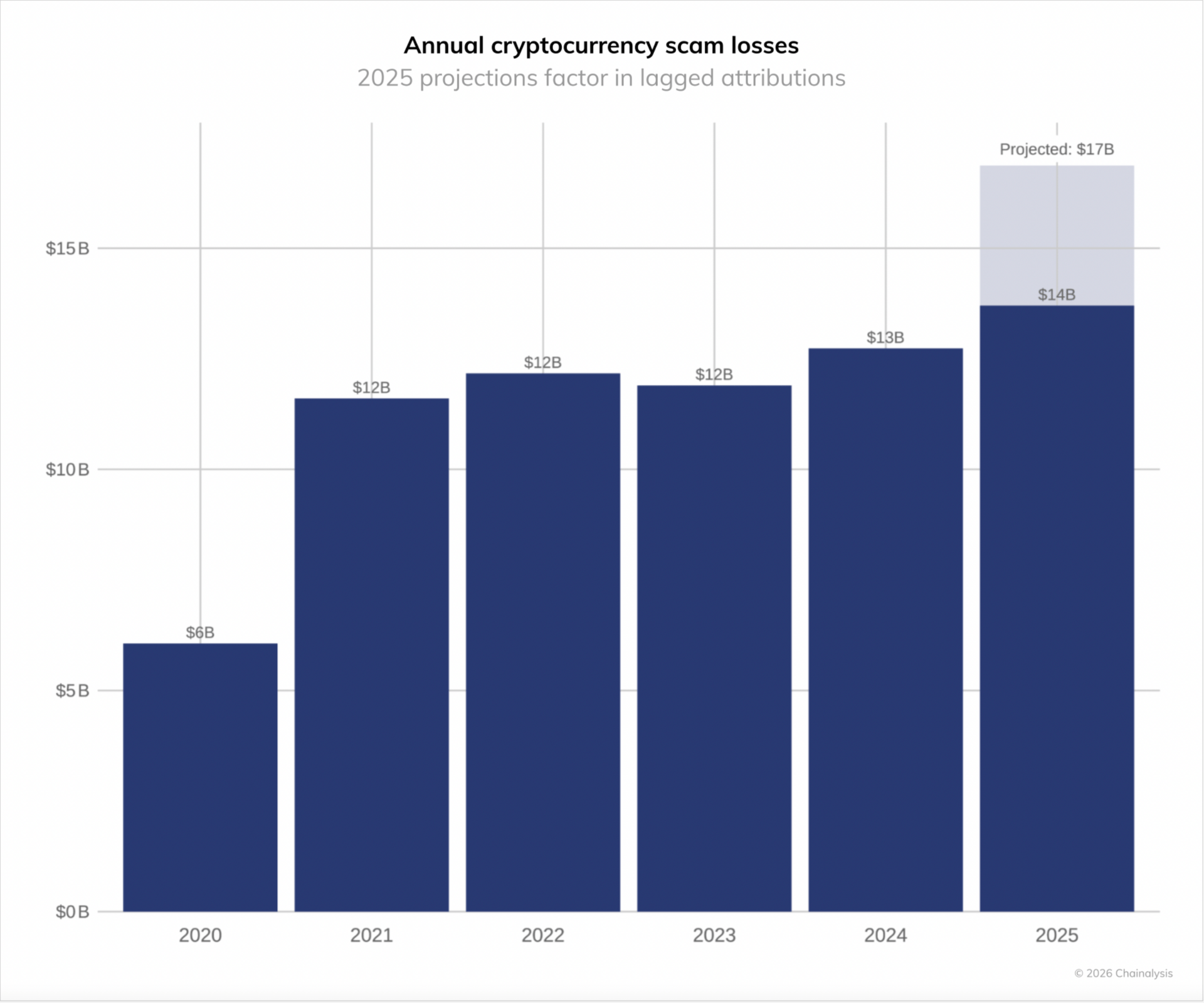

AI: Who’s Really In Charge? 🧠

Don’t forget to cast your vote 👇 Your brain is very good at one thing:

Trusting familiar patterns.

→ If a voice sounds right, you believe it.→ If a face looks real, you relax.→ If a message feels official, you comply.

That wiring worked great when the biggest threat was a raccoon stealing your trash.

It works a lot less well when a machine can generate a perfect human voice in three seconds, clone a face in five, and send you a fake “support” message before you finish your coffee.

Which might explain why scammers just pulled off their most profitable year ever.

But the scams are just the...

Tanya on .

Gold hit the gas (crypto didn’t) 👀

Don’t forget to cast your vote 👇 ❗This morning, the market woke up to a weird headline:

The administration is probing Fed Chair Jerome Powell.

Not CPI.Not jobs.Not war.

Just… the referee suddenly being in the news.

And when the referee becomes part of the story, markets do what they always do:

They start looking for something solid to grab onto.

Gold grabbed the spotlight first. THE BREAKDOWN 1) Gold Did What Gold Has Always Done.

Gold has had the same job for about 5,000 years: Show up when humans get nervous about institutions.

When traders hear words like: investigation political...

Tanya on .

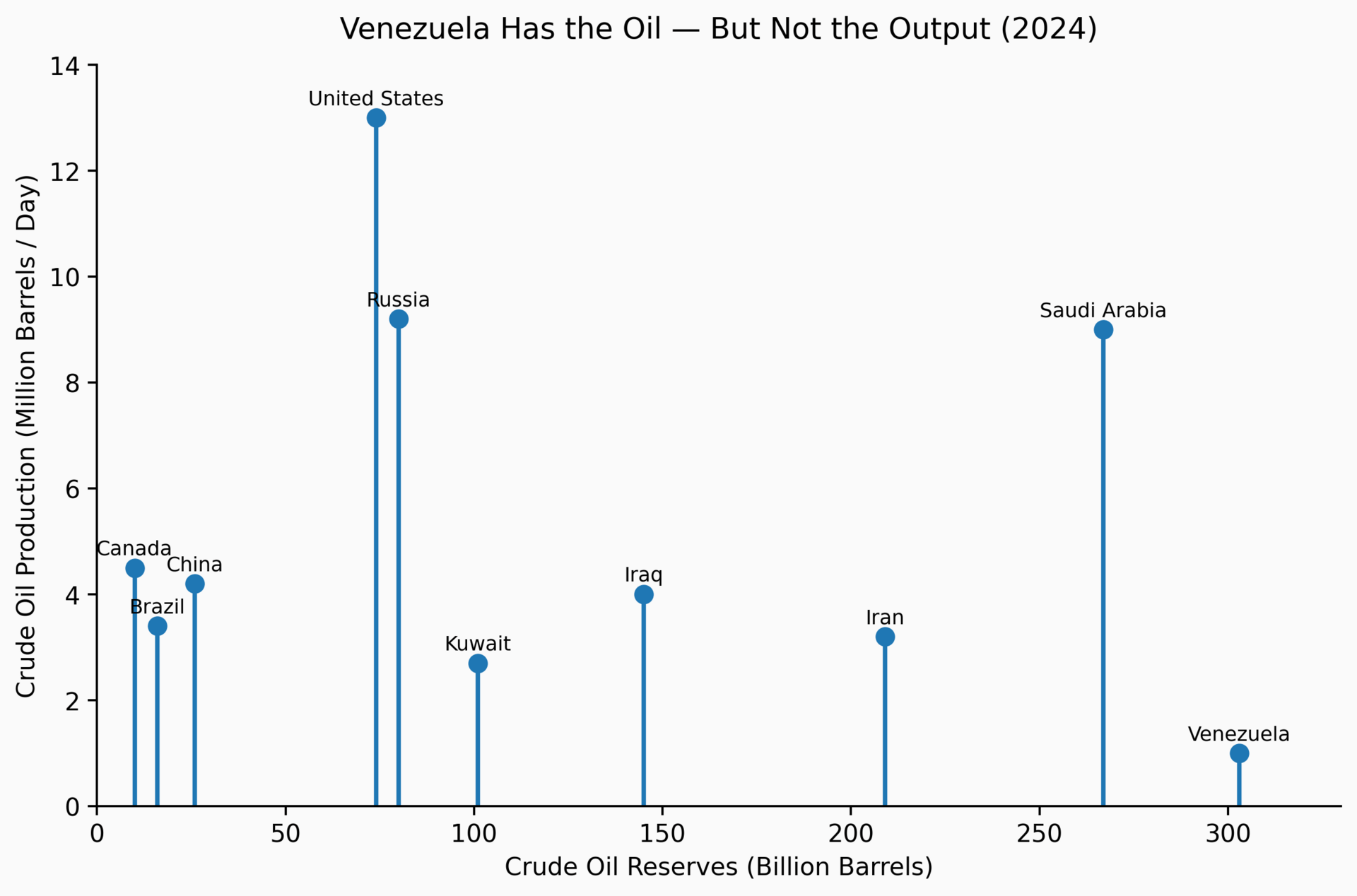

The Oil Story Sounds Better Than the Math

Don’t forget to cast your vote 👇 ❗Oil stocks are back in the spotlight.

Venezuela headlines. Geopolitical tension. Talk of massive reserves suddenly becoming accessible. Traders see optional upside everywhere.

But when you zoom out, the numbers tell a quieter story.

→ Crude is still sitting in the $50s.→ Earnings estimates for the major producers are still falling into 2026.→ Valuations aren’t exactly screaming “cheap.”

Yet stocks tied to the narrative continue to attract attention.

That gap — between story momentum and earnings reality — is where traders tend to get sloppy.

And where traps...

Tanya on .

The Oil Story Sounds Better Than the Math

Don’t forget to cast your vote 👇 ❗Oil stocks are back in the spotlight.

Venezuela headlines. Geopolitical tension. Talk of massive reserves suddenly becoming accessible. Traders see optional upside everywhere.

But when you zoom out, the numbers tell a quieter story.

→ Crude is still sitting in the $50s.→ Earnings estimates for the major producers are still falling into 2026.→ Valuations aren’t exactly screaming “cheap.”

Yet stocks tied to the narrative continue to attract attention.

That gap — between story momentum and earnings reality — is where traders tend to get sloppy.

And where traps...

Tanya on .

Wait… Intel Actually Shipped Something?

Don’t forget to cast your vote 👇 ❗Don’t get too excited — Intel didn’t suddenly solve semiconductor geopolitics, reclaim data center dominance, or reinvent Moore’s Law overnight.

But after years of missed timelines and manufacturing stumbles, the company finally did something the market had quietly stopped expecting: it delivered.

For the better part of a decade, Intel has been trading on future tense.

Next node. Next roadmap. Next turnaround.Every year came with slides, timelines, and promises — and every year the market learned to discount them.

Meanwhile, $AMD kept taking share. Arm...

Tanya on .

Why the “Oil Shock” Never Came

Don’t forget to cast your vote 👇 ❗On paper, this should’ve been an oil shock.

Over the weekend, U.S. forces carried out a military operation in Venezuela, capturing President Nicolás Maduro. Within hours, President Donald Trump said the U.S. would temporarily “run” the country during a transition and signaled that American oil companies were prepared to rebuild Venezuela’s energy infrastructure.

Venezuela holds the largest proven oil reserves in the world — roughly 300 billion barrels, more than Saudi Arabia.

Yet crude prices barely moved.

Instead, something more subtle happened. THE...

All Rights Reserved © 2025 Trading Lessons