Don’t forget to cast your vote 👇

❗Don’t get too excited — Intel didn’t suddenly solve semiconductor geopolitics, reclaim data center dominance, or reinvent Moore’s Law overnight.

But after years of missed timelines and manufacturing stumbles, the company finally did something the market had quietly stopped expecting: it delivered.

For the better part of a decade, Intel has been trading on future tense.

Next node. Next roadmap. Next turnaround.

Every year came with slides, timelines, and promises — and every year the market learned to discount them.

Meanwhile, $AMD kept taking share. Arm kept creeping into PCs. Foundries elsewhere kept moving faster.

This week, Intel finally put something concrete on the table.

At CES this week, Intel formally launched its Core Ultra Series 3 “Panther Lake” chips — the first commercial products built on its long-awaited 18A manufacturing process. Production is live. Orders are open. The factories are running.

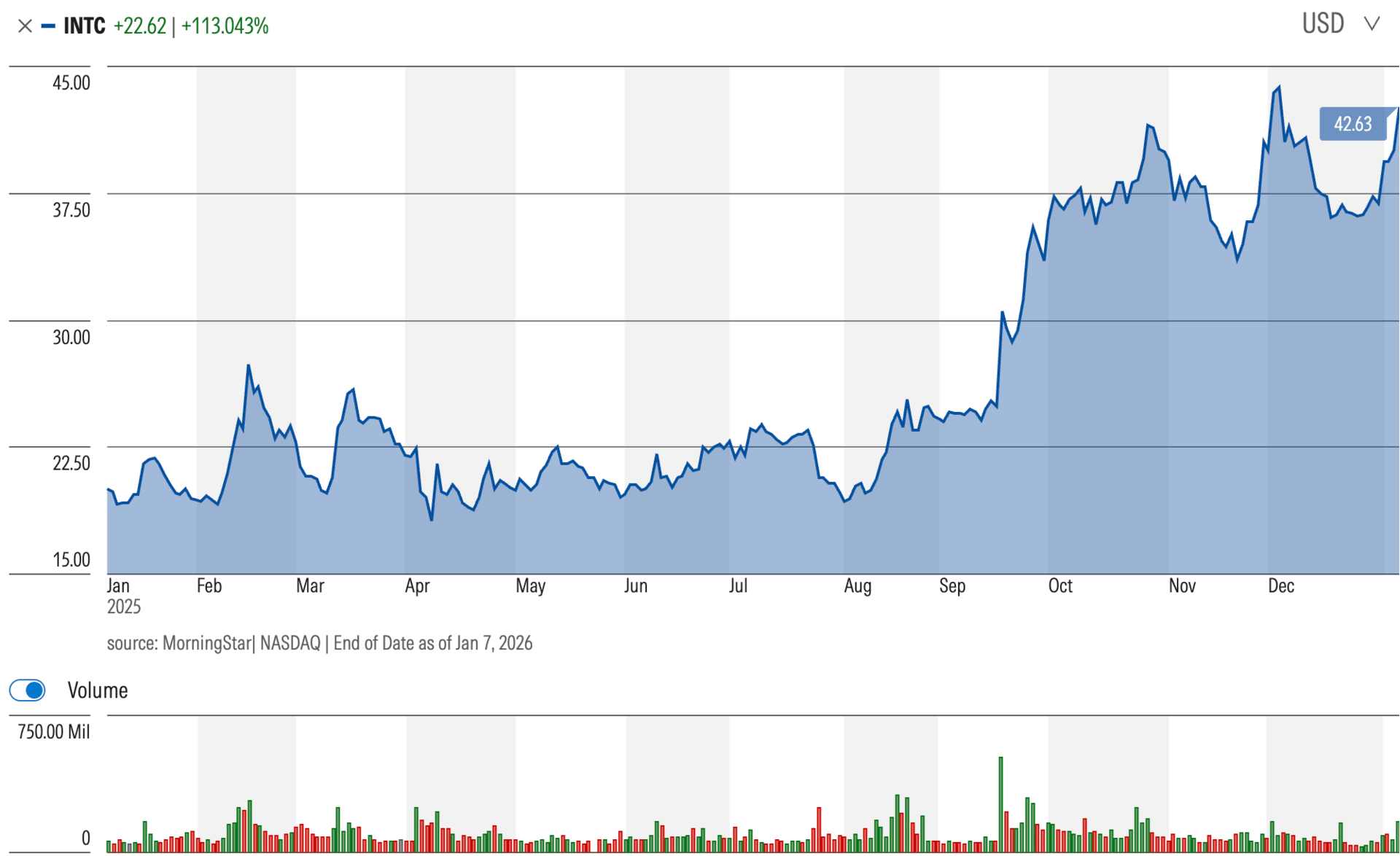

Intel stock popped more than 6% on the news.

Not because investors suddenly fell in love with laptop CPUs — but because execution finally showed up.

THE BREAKDOWN

1) This Was a Manufacturing Test — Not a Product Launch

18A represents Intel’s first serious attempt in years to reset its process roadmap after a long stretch of missed nodes and delayed ramps. Those misses weren’t cosmetic — they broke customer confidence and left fabs underutilized.

Shipping a real product on a new node changes the conversation.

→ It tells customers the factory can run.

→ It tells partners the timelines might actually stick.

→ It tells investors the engineering machine still works.

In semiconductor land, that’s currency.

2) Intel’s Downtrend Was Self-Inflicted

Intel didn’t lose relevance because demand disappeared. It lost momentum because execution fell behind.

Intel’s turnaround story has spent most of the past decade trapped in a feedback loop.

① Manufacturing delays made chips less competitive.

② Weaker chip demand left fabs underutilized.

③ Underutilized fabs made it harder to justify the next wave of investment.

Rinse. Repeat.

Opening the foundry to outside customers helped on paper, but without proof of manufacturing reliability, large customers stayed cautious. Credibility, once lost, takes time to earn back.

Panther Lake marks the first real break in that pattern.

This wasn’t a lab demo or a slide deck milestone. It’s a shipping product on a new node — the biggest manufacturing upgrade Intel has pulled off in roughly a decade.

As one analyst put it this week, Intel had developed a credibility gap. Panther Lake doesn’t solve everything — but it breaks the negative loop.

❝ The Lesson ❞: Roadmaps don’t trade. Products do.

3) Market Traded Confidence

This move wasn’t about laptops suddenly flying off shelves or near-term earnings upside.

It was about the probability tree. When execution shows up, its branches start to carry weight again.

If Intel can repeatedly deliver on advanced nodes:

External customers get more comfortable committing capacity

Future nodes become commercially believable

Factory utilization improves

Capital leverage starts working instead of bleeding

That’s a very different long-term setup than “permanent execution discount.”

The market isn’t declaring victory. It’s removing a penalty.

And that’s what the tape repriced.

Not perfection or dominance. Just proof.

❝ The Lesson ❞: Intel’s rally was driven by execution, not demand.

THE CAPSTONE

Intel finally gave the market something it hasn’t had in years: proof.

Panther Lake doesn’t solve market share overnight. It doesn’t guarantee foundry wins. It doesn’t rewrite competitive dynamics by itself.

But it changes the math. Execution risk just compressed — and that’s what the rally actually priced.

Now the burden flips: Intel doesn’t need hype — it needs consistency.

The next few quarters decide whether this was a one-off… or the start of a rerate cycle.

LESSON OF THE DAY:

💬 We Want To Hear Your Story:

Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

Was this email forwarded to you? Don’t miss out on future stories — subscribe to the TradingLessons and get our daily market breakdown delivered straight to your inbox.

❗ P.S. – If you no longer want to receive occasional emails from us and you want to unsubscribe, scroll to the bottom of this email and click the “Unsubscribe” link located right under the disclaimer 👇

All Rights Reserved © 2025 Trading Lessons