Don’t forget to cast your vote 👇

Did you read yesterday’s edition?

Bitcoin ( ▼ 13.05% ) was wobbling.

Today… it slipped after Treasury Secretary Scott Bessent made it clear the government isn’t riding to the rescue — and crypto took the hint.

While everyone was staring at crypto, something slower — and arguably more important — was happening in the biggest stocks on Earth.

So let’s put Bitcoin on pause for 60 seconds.

Because today’s story isn’t about tokens.

It’s about the “Magnificent Seven.”

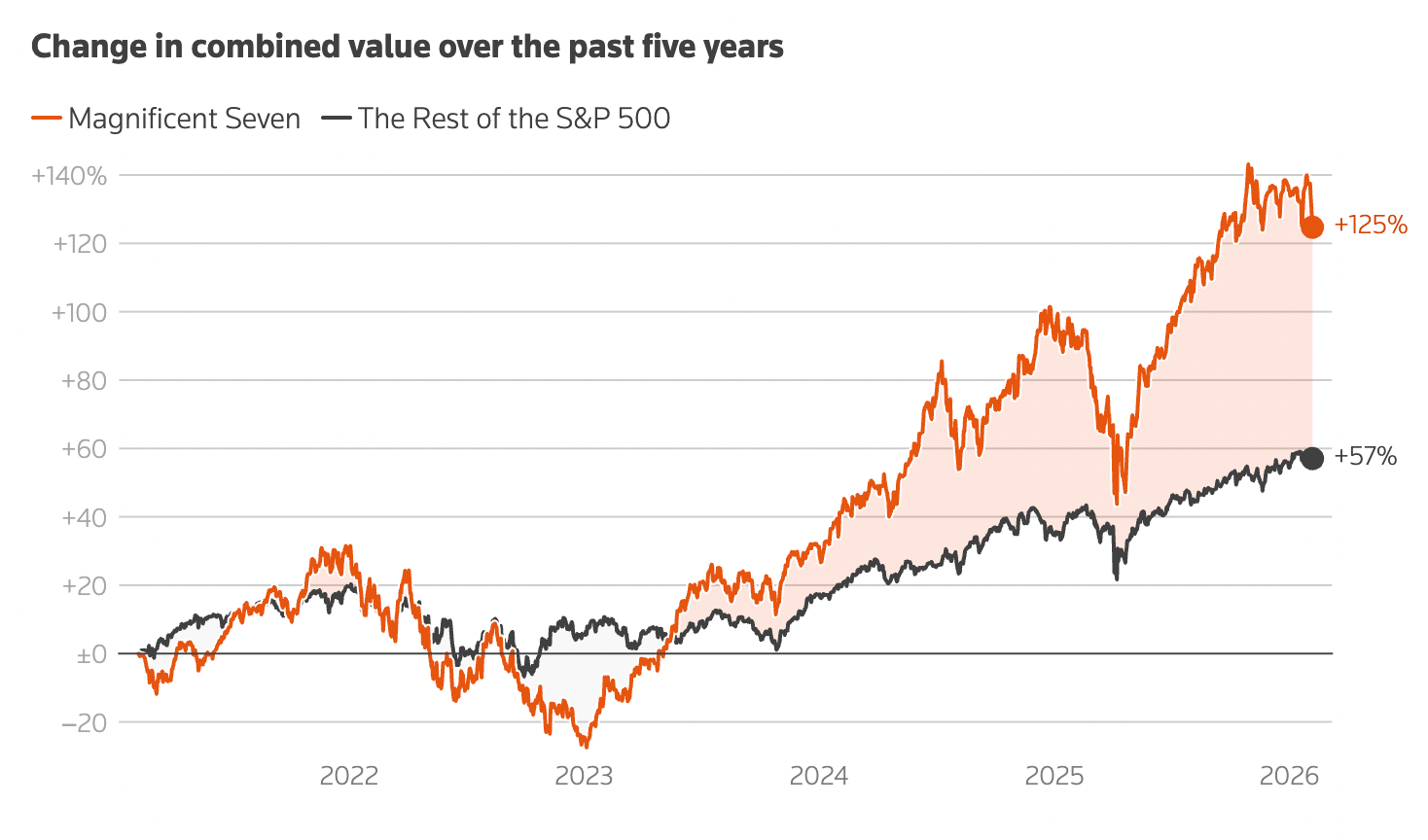

For years, “own the Mag 7” was the easiest trade in markets. It worked so well it stopped feeling like a trade at all.

Now it feels… different.

And that’s usually how bigger shifts begin.

What Changed?

Markets have a funny habit. They reward the obvious trade… right up until it becomes too obvious.

For years, “own the Magnificent Seven” was the default setting.

And why not?

Their combined market cap hit $21.5 trillion — bigger than the GDP of every country on Earth except the U.S.

But lately, the “Magnificent” part has started to feel… optional.

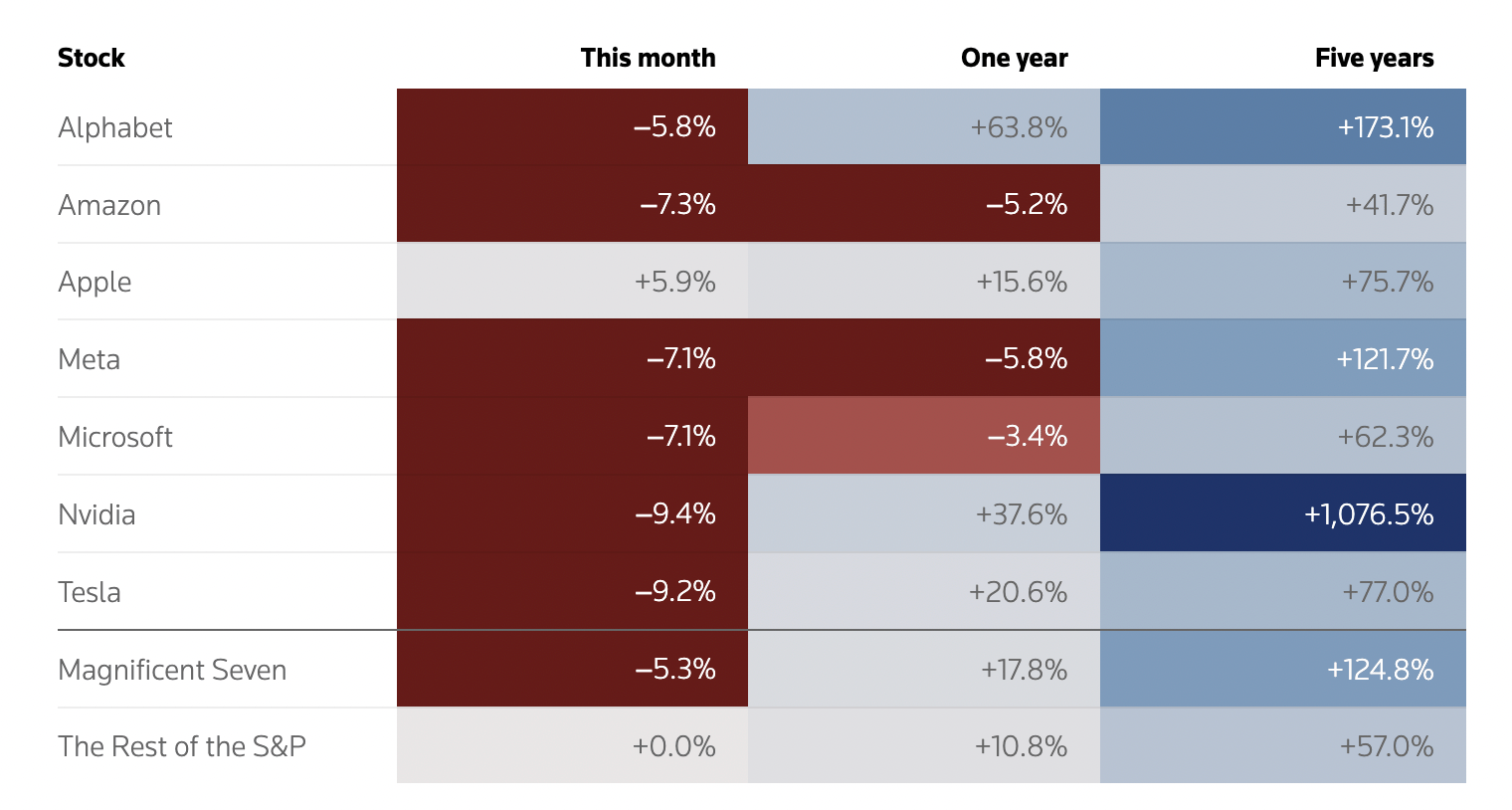

Last year, five of the seven — Amazon, Apple, Meta, Microsoft, and Tesla — trailed the S&P 500.

source: Reuters

And that underperformance has carried into 2026, even though their index weight is still doing the heavy lifting.

So what changed?

The Issue

For years, the Mag 7 had the perfect combo:

cash flow rising + growth narrative intact.

Now that combo is breaking.

Gina Martin Adams (HB Wealth) points to the key shift:

Cash flow peaked in 2024

Then it started slipping in 2025

At the same time, spending sped up. These companies are writing bigger checks at the exact moment the cash coming in is no longer accelerating.

And the biggest checks have one label on them:

AI.

Last year, the Magnificent Seven spent an estimated $320B chasing it — buying chips, building data centers, upgrading infrastructure, and picking up AI startups.

So the setup investors are staring at is simple:

High spending today

Payoff later

And cash flow isn’t getting stronger in the meantime

That’s why the stocks feel heavier.

Because the market is asking a more annoying question:

When does this start showing up in results?

1 Amazon is a clean example of the new math

Amazon tells the story better than any chart.

In 2025, the stock gained 4% — the weakest in the Mag 7, and about 13% behind the S&P 500.

Not a disaster. Not a win either.

What matters is what was happening offstage.

Through the first three quarters of 2025, Amazon’s CapEx hit $89.9B, as CFO Brian Olsavsky put it, to “support demand for AI and core services.”

Then came Q4.

Amazon ( ▼ 4.42% ) just reported earnings — and the stock slid.

→ EPS came in at $1.95 vs. $1.97 expected.

→ Sales beat at $213.4B vs. $211.4B expected.

But guidance is what spooked the market.

❗ For Q1, Amazon sees:

Sales of $173.5B–$178.5B (Street was at $175.6B)

Operating income of $16.5B–$21.5B — below consensus at $22.18B

In short: Big spend today. Unclear payoff tomorrow.

That’s the new math investors are working through — not just for Amazon, but for the whole group.

SPONSOR BREAK presented by TheOxfordClub*

How Mitt Romney Turned $450K Into Up to $100 Million (Tax-Free)

It wasn’t stocks. It wasn’t real estate. It was a little-known investment vehicle that turned Mitt Romney’s $450,000 into as much as $100 million and Peter Thiel used to turn $2,000 into $5 billion within two decades. Now, thanks to a new executive order, regular Americans can access the same type of investment.

Get more details here >>

2 The question isn’t AI hype — it’s AI adoption

Gina Martin Adams makes a simple distinction:

It’s not enough for companies to “try” AI.

It needs to become a must-have, deeply embedded into processes, driving margin expansion and productivity growth.

Right now, full adoption is slower, for boring reasons that still win:

ROI uncertainty

messy legacy systems

skilled labor shortages

decisions that touch engineering, legal, security, compliance, and finance

In other words: the tech moves fast. Organizations don’t.

So while the Mag 7 build, the other 493 stocks in the S&P 500 get a shot at being the better growth story.

And investors are noticing.

3 Why Experts Say That’s “Healthy”

Zoom out.

Tech is the worst S&P 500 sector this year (down ~5%).

Energy and consumer staples are up double digits.

That flip is the whole story.

Stephen Parker at JPMorgan calls it “very healthy” because the market is finally broadening — less “Mag 7 or bust,” more everything else.

Bank of America flow data supports it: In the past month, BofA clients funneled more into consumer staples than any four-week stretch since 2008. And they’ve been net sellers of tech four of the past five weeks.

Earnings: mixed results, same theme

source: Reuters

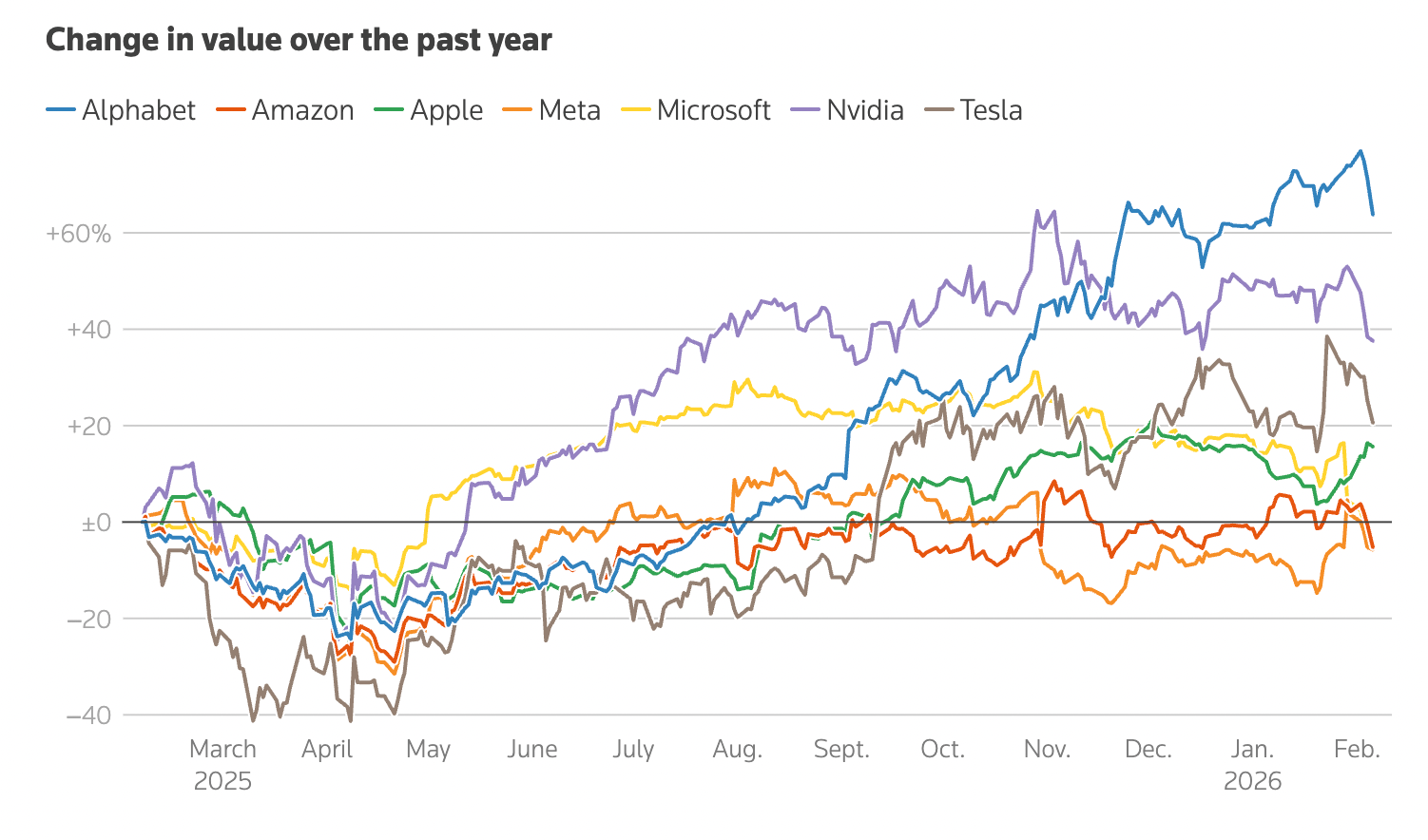

Recent Mag 7 reports didn’t give the market one clear story — they gave it a split screen.

A Microsoft ( ▼ 4.95% ) sold off despite beating on EPS and revenue after tempered Azure guidance

Q2 FY2026 EPS: $4.14 vs $3.86 expected

Revenue: $81.27B vs $80.28B expected

Azure growth near 40%, but guiding 37%–38% next quarter

CapEx in Q2: $37.5B

Market reaction: “Beat” isn’t enough if the spending is still accelerating and growth is decelerating.

B Meta ( ▲ 0.18% ) popped after a blowout and strong guidance

EPS: $8.88; revenue $59.85B (both ahead)

2026 AI CapEx expected $115B–$135B (up from $72B in 2025)

Q1 revenue guidance: $53.5B–$56.5B

Same category of story (spend big on AI)… different market reaction because guidance soothed nerves.

source: Reuters

C Tesla ( ▼ 2.17% ) dropped after an annual revenue decline, then rebounded on a pivot toward robotics

First-ever annual revenue decline (down 3% YoY)

Operating costs up 39% in Q4

Deliveries: 1.636M, nearly 9% fewer than 2024

Forward P/E: 163.65

D Apple ( ▼ 0.21% ) posted record EPS and revenue

EPS: $2.84 vs $2.65 expected

Revenue: $143.76B vs $138.25B expected

Revenue up 16% YoY, EPS up 19% YoY

Greater China up 38% YoY

E Alphabet ( ▼ 0.54% ) posted strong Q4 results

EPS: $2.82 vs ~$2.64 expected

Revenue: $113.83B vs $111.4B expected

Net income: $34.5B (▲ 30% YoY)

Operating margin: 31.6%

Google Cloud revenue: $17.7B (▲ 48% YoY)

Search & other ad revenue: $82.28B

F Amazon ( ▼ 4.42% ) slid on Q4 results

EPS: $1.95 vs $1.97 expected

Revenue: $213.4B vs $211.43B expected

Q1 sales guidance: $173.5B–$178.5B vs $175.62B expected

Q1 operating income guidance: $16.5B–$21.5B vs $22.18B expected

Stock reaction: down ~6.7% after the report

SPONSOR BREAK presented by BehindtheMarkets*

A U.S. “birthright” claim worth trillions – activated quietly

A tiny government task force working out of a strip mall just finished a 20-year mission.

And with almost no media coverage, they confirmed one of the largest U.S. territorial expansions in modern history…

A resource claim worth an estimated $500 trillion.

Thanks to sovereign U.S. law, this isn’t just a national asset.

It’s an American birthright.

That means every citizen now has the legal right to stake a claim…

But very few even know the opportunity exists.

If you want to see how you can get in line for your portion of this record-breaking windfall…

I’ve assembled everything you need to see inside a new, time-sensitive briefing:

Get all the details here – while the claim window remains open.

Meanwhile, software is getting hunted

This part is important because it explains why “tech weakness” doesn’t feel evenly distributed.

Short sellers have posted about $24B in paper gains in the software selloff (S3 Partners data).

Software + AI-related stocks are down roughly 20% since the start of the year.

Leon Gross (S3) called it out:

This is software-specific — the broader Mag 7 is essentially unchanged.

The trigger point in this latest leg:

Anthropic introduced a new productivity tool Monday… and the selloff intensified.

Short interest is rising in names including:

Microsoft

Oracle

Broadcom

Amazon

And the positioning is shifting:

Gross said Microsoft usually behaves like a “reversal stock” with shorts covering on the way down.

But now it’s trading like a momentum-driven distressed name — with shorts increasing into weakness.

The scoreboard

The iShares Expanded Tech-Software ETF (IGV) tells the story cleanly:

Down 8% this week

Down >21% this year

Down 30% from its September all-time high

Individual damage:

Intuit and DocuSign down >30%

Microsoft down 15%

Oracle down 21%

Salesforce, Adobe, ServiceNow down >20%

One small stabilizer:

A banker noted there isn’t too much panic on the credit side yet — revolving credit lines aren’t being drawn.

And the next catalyst is close:

Several software companies report earnings in the coming days.

So…

…the Mag 7 didn’t suddenly become “bad companies.”

But the market is treating them differently:

Cash flow peaked (per HB Wealth)

CapEx is still accelerating

AI adoption is taking longer than the hype cycle

Rotation is showing up in sector returns and real fund flows

Software is facing a separate, more aggressive de-rating with shorts pressing

This doesn’t mean tech is “over.”

It means 2026 is starting to price something the last two years didn’t:

AI spend without immediate payoff.

Lesson of the Day

💬 We Want To Hear Your Story:

Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

Was this email forwarded to you? Don’t miss out on future stories — subscribe to the TradingLessons and get our daily market breakdown delivered straight to your inbox.

❗ P.S. – If you no longer want to receive occasional emails from us and you want to unsubscribe, click here 👉 “Unsubscribe” . Thank you!

All Rights Reserved © 2025 Trading Lessons