.

Fundamental Analysis…The Big Picture

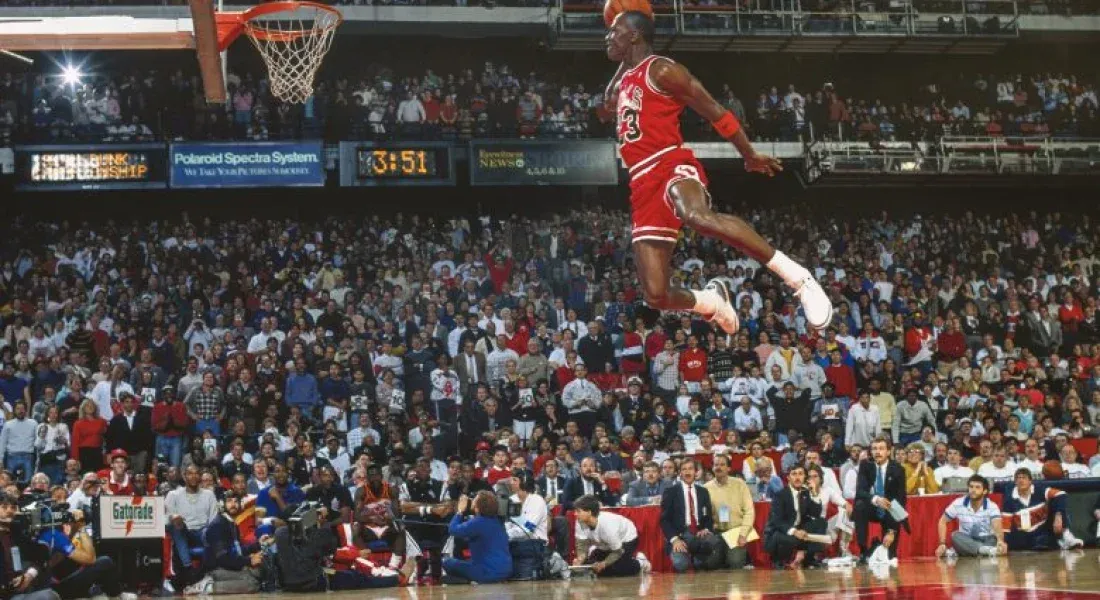

When reporters would ask Michael Jordan if he could fly, he did not answer “no.” Instead Jordan would reply, “For a little while.” That’s the way it is with markets and their movements away from the underlying fundamentals that support them. Rather than enter a futile debate between “macro” thinking and technical analysis, a few basic concepts can help a trader navigate the market’s turbulence more confidently. Fundamental analysis is the practice of analyzing commodities and trying to predict where their prices should be trading and what they will do in the future. The building blocks of fundamental analysis are supply and demand. In fundamental analysis, commodity price movements can be broken down into two simple formulas: Demand > Supply = Higher Prices Supply > Demand = Lower Prices These are very simple equations, but can get much more complicated when you try to forecast prices in the future. Commodities trade in cycles. At some times, supplies will be tight and prices will be high. At other times, we just have too much of a commodity and prices fall accordingly. Both of these situations can lead to profitable trading opportunities. Here are a few things to remember: The supply of a commodity is the amount that is being produced during the current year plus the amount that is carried over from previous years of production. For example, the current supply of corn would include the total of crops in the ground and the amount that is left over from the previous season. Typically, the more that is carried over from the previous season, the lower the prices can fall. A variety of factors can affect the supply of commodities, such as weather, amount of acres planted, production strikes, crop diseases and technology. The main thing to remember when using fundamental analysis is that high commodity prices will lead to an increase in production, as it is more profitable to produce commodities when prices are higher. And, as you might expect, demand will typically drop as prices move higher. Commodity demand is the amount that is consumed at a given price level. Generally, demand will increase when the price of a commodity moves lower. Conversely, demand will decrease as the price of a commodity increases. There’s an old saying among commodity traders that low prices cure low prices. This means that more of a commodity will be consumed at lower prices, which lowers the supply, and thus prices will eventually increase.. Supply and demand can be thought of as an unbreakable law in the futures business. To trade futures products without doing your due diligence as to the basic supply and demand projections for a commodity, whether it’s pork bellies or Treasury bonds (everything can be thought of as a commodity, whether it is corn, wheat, cattle, currencies, metals, energy, or interest rates), is to tempt fate. If you imagine the CME as the Wal-Mart of futures products, then some understanding of the economic conditions of the global “shoppers” can only enhance your risk management. The great Paul Tudor Jones once said, “Don’t tell me why, tell me when.” No other statement ever did more to devalue fundamental analysis to its technical counterpart. After all, an Economics or Finance degree is much more expensive than a weekend seminar on charts at the local Hilton Inn. But, human nature (and thus human action) includes a strong desire to attach meaning to our interaction with the world around us. Therefore, fundamental analysis is a basically necessary characteristic of the complete trader. Don’t believe it? Ask any chartist what he thinks about a trade. You won’t be able to count to 10 before he brings up some macroeconomic or global news tidbit. The key to building a sound fundamental case for market action has been greatly helped, but at the same time greatly complicated by the internet and the vast amount of rapidly available information it provides. The ability to disregard the obvious and filter to the relevant is extremely important. Many market pundits will tell you that “Everything that can be known is already in the price.” If this oft-repeated cop-out were true, then why do markets move at all, let alone violently and unpredictably? Information and more directly, understanding, are not socialized goods no matter what your download speed. Many private research firms produce analysis that’s far superior to the government’s spending billions in the process. Try using following rules when developing a trade idea: – Think of the fundamentals in a strategic sense.

– Incorporate any number of technical or qualitative tools to help manage the risk of taking action on that strategy. Those tools and P/L movements are tactical. The ability to blend these understandings into a workable discipline is equivalent to trading profits. (Feeling that the dollar is poised to fall because of domestic money printing and wanting to buy gold on that feeling is strategic. Turning that knowledge into profits is tactical.)

– Picture yourself buying a Treasury bond contract. The seller could be anyone in the world from Goldman Sachs, the Government of China, or another bold individual like you. A certain amount of self-confidence is a given. Taking ALL the weapons at your disposal into that David vs. Goliath battle would make sense. Now let’s take some of these basic concepts and put them into real-time scenarios. If only charts matter, why all the trading around the release? When trading futures, you will find that a very important tool to keep handy is your calendar. This is because important economic and inventory reports come out at regularly scheduled dates and times each month. These reports coincide with periods of high volume and high volatility that support the base case for fundamental analysis. (If only charts matter, why all the trading around the release?) Institute of Supply Management Reports (ISMs) The end of the month begins the cycle. The first, fresh data on the real economy comes with the regional and national releases of the Institute of Supply Management Reports (ISMs), a survey of actual managers’ planning in the supply chain for production and sales projection. Old timers will know these indicators as the Purchasing Managers’ Report, and the acronym NAPM (napalm!). Sourced from real buyers of real materials and aided by advances in supply chain software, this incredibly important real-time data set can move markets dramatically when released just before 10 am ET on the last couple of business days of the month. It is the freshest look at the most recent month’s activity with a diffusion index for the month ahead. “Un-enjoyment day” The first Friday of every month is jokingly called “Un-enjoyment day” among professional traders because of the 8:30 ET release of the Employment Report. This is when the Bureau of Labor gives us their best guess on the number of new hires and the unemployment rate. A “guess” is the proper word, but this number causes huge volatility in the markets because of its obvious importance and newspaper headline strength. The actual data generally is massively off base. The average miss for the data is roughly 110,000 workers, and huge revisions and seasonal adjustments are used to clean the numbers over time. Only a government entity can be that far from reality and still garner such huge respect. You could say that more money is made – and lost – on this bad estimate than any other data set. Even with all of its flaws, no trader in the game can dare wake up after 8:30 am

ET on the first Friday of the month and miss the Employment report. Reports for retail sales and inflation Finally, the reports for retail sales and inflation usually are released over several days around the middle of every month. Consumption is more than 2/3 of the United States economy, and services have taken over manufacturing in the information age. Inflation (or the lack thereof) and inflation expectations are the most important inputs for interest rate pricing. The Federal Reserve strips out food and energy prices because of their volatility, and produces a “core” metric that guides policy. The public does not have the luxury of excluding food and energy from their bills, however. The inflation figures also influence trading in the commodity markets, from oil to corn. Futures markets provide a great venue to trade inflationary themes because most other asset classes do not perform well when inflation is brewing. In fact, the inflationary experience of the 1970s and ‘80s was the foundation of the growth and product innovation that defined exchange-traded futures. In many ways, these new and innovative products provided ways to hedge against the scourge of inflation, and aided the country’s economic advance. For oil, every Tuesday and Wednesday the crude oil and energy complex gets data on inventories and production; these inputs should not be missed. Energy markets swing wildly on the data and prices far from fundamental reality can trade aggressive volume. Trading during these few minutes is not for the weak or uncommitted, but profit potential is high and quick. Various private projections – usually given first to subscribers – provide very good estimates of crop yields and farming conditions and influence grain futures massively. The key difference from other economic news is the asymmetric release but also the better data. In summary, new traders, and even experienced traders, should use a long-term strategy when using fundamental analysis to forecast commodity prices. You should look for trends that are developing that will cause a shift supply and demand factors and make your trades accordingly.

image source: the balance.com

DAILY

Level Up Your Trading IQ, For Free!

No More Guesswork,

Just Trading Bliss.✨