Don’t forget to cast your vote 👇

Nobody likes buying insurance.

It feels boring.

It feels unnecessary.

It feels like paying for something you hope you’ll never use.

You don’t wake up excited to buy homeowners insurance.

You don’t brag to friends about your deductible strategy.

You don’t refresh your insurance app during lunch.

Until the risk changes.

Then suddenly everyone wants coverage.

Markets treat gold the same way.

Gold isn’t an interest-bearing asset. It’s not supposed to be thrilling. It doesn’t invent anything, disrupt anything, or scale anything.

Gold is insurance against things going sideways.

And this week… that insurance premium just surged.

→ Gold pushed toward $5,000 per ounce.

→ Silver cracked $100 for the first time ever.

Not because something broke overnight.

…but because the background risk level keeps creeping higher.

What Just Happened

Precious metals just had their best week since 2020.

Gold is up roughly 13% year-to-date.

Silver is up nearly 29% year-to-date.

→ Private investors are piling in.

→ Central banks are still accumulating.

→ Safe-haven flows are quietly rebuilding.

source:tradingeconomics

Silver isn’t just tagging new highs — it’s moving near-parabolic.

→ China has been hoarding silver for domestic use.

→ Supply growth is tight.

→ Industrial demand remains strong.

Which means there’s less slack in the system when money starts rotating into metals.

source: tradingeconomics

One strategist summed it up simply: “The cat is out of the bag.”

Once momentum shows up in defensive assets, the crowd notices quickly.

Why The Market Is Buying “Insurance”

This rally isn’t random. Several quiet forces are stacking on top of each other:

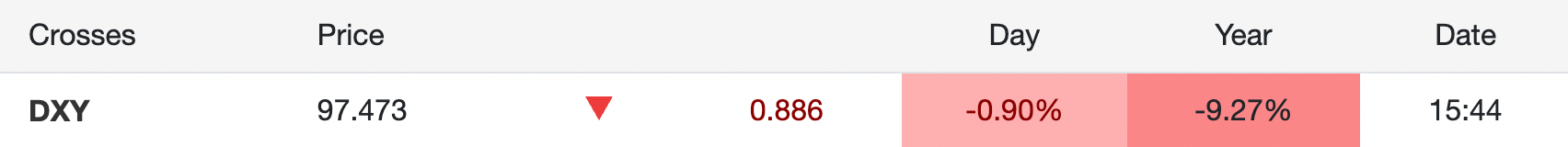

1 The Dollar Is Softening

A weaker dollar makes hard assets more attractive globally.

When the dollar weakens, metals tend to catch a bid.

source: tradingeconomics

2 Interest Rates Are Expected To Drift Lower

Gold doesn’t pay interest.

So when real yields fall ▼, gold becomes more competitive versus bonds and cash.

Markets are pricing additional rate cuts later this year.

Lower yields → cheaper opportunity cost → stronger gold demand.

3 Government Debt Is Growing

Large fiscal deficits mean more borrowing.

More borrowing means more bond supply.

More bond supply pressures long-term confidence.

Some institutional investors are already reassessing exposure to U.S. Treasuries.

A Danish pension fund publicly exited Treasuries this week amid geopolitical tensions tied to Greenland.

Big Northern European investors are reportedly reviewing U.S. asset exposure more broadly.

❗That doesn’t mean panic. It means portfolios are quietly adjusting risk assumptions.

3 Geopolitical Friction Keeps Adding Noise

→ Trade tensions.

→ Tariff uncertainty.

→ NATO friction.

→ Political pressure on central banks.

None of these individually cause panic.

But together, they raise the background volatility level — the exact environment where insurance assets tend to reprice higher.

SPONSOR BREAK presented by TheOxfordClub*

Strange New Wonder Metal Outperforms Silicon Up to 100X

Nvidia just partnered with the tiny company that holds 250 patents.

Here’s why it could become the most important stock in the world.

WHY SILVER IS MOVING EVEN FASTER

Silver is the wilder cousin of gold.

It behaves like:

A monetary hedge

An industrial commodity

A speculative momentum trade

All at once.

Silver has surged more than 200% over the past year.

source: tradingeconomics

Industrial demand remains strong.

Physical supply remains tight.

Liquidity is thinner than gold.

Which means when momentum builds, price moves get exaggerated quickly — in both directions.

Some analysts are already warning that silver can overshoot and retrace violently once momentum cools.

Translation: Silver doesn’t tap the brakes gently.

👀 For the Curious:

Ray Dalio consistently recommends keeping 5%–15% of a portfolio in gold as protection against:

→ Currency debasement

→ Rising debt

→ Geopolitical stress

→ Shifts in the global monetary system

He calls gold “non-fiat money.”

That view is quietly spreading.

Central banks have been buying gold aggressively ever since Russian reserves were frozen.

At the same time, private investors are piling into gold ETFs.

Goldman Sachs just raised its year-end gold target to $5,400, citing a surge in private-sector buying layered on top of ongoing central bank accumulation.

Their takeaway: There simply isn’t enough physical gold to absorb all the new demand without higher prices.

Bank of America is even more aggressive — floating scenarios north of $6,000 if capital rotation accelerates.

When the big players start quietly buying insurance, it’s usually because the weather is changing — even if the sky still looks blue.

Lesson of the Day

💬 We Want To Hear Your Story:

Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

Was this email forwarded to you? Don’t miss out on future stories — subscribe to the TradingLessons and get our daily market breakdown delivered straight to your inbox.

❗ P.S. – If you no longer want to receive occasional emails from us and you want to unsubscribe, click here 👉 “Unsubscribe” . Thank you!

All Rights Reserved © 2025 Trading Lessons